Matchless Liquidity Position Formula

Since it indicates.

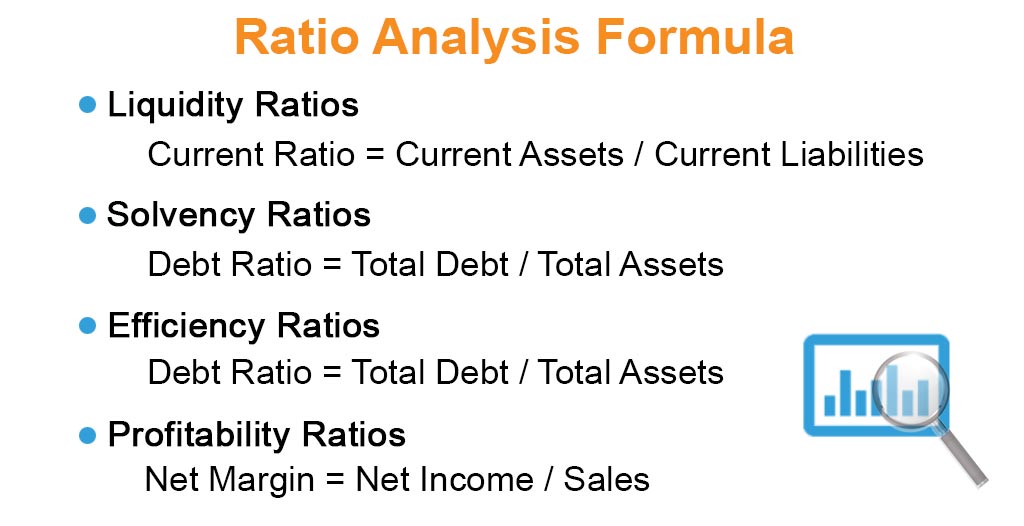

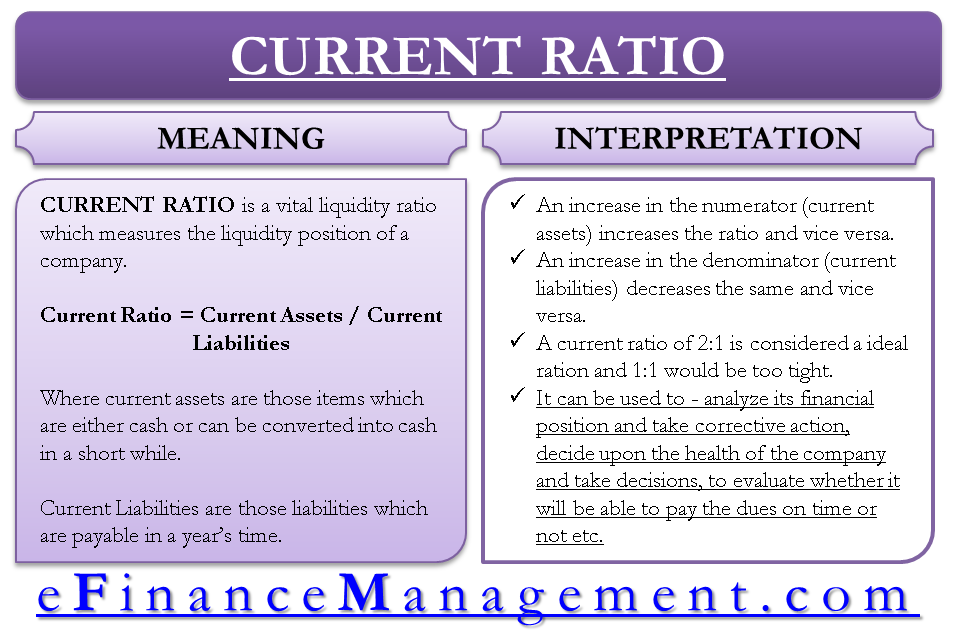

Liquidity position formula. These include working capital and the current ratio. ROE Net Income of the company Shareholders Equity As shown above as the company has no Share capital in their financial statement the company ROE cannot be calculated. Net liquid assets is a term used to define the immediate liquidity position of a company.

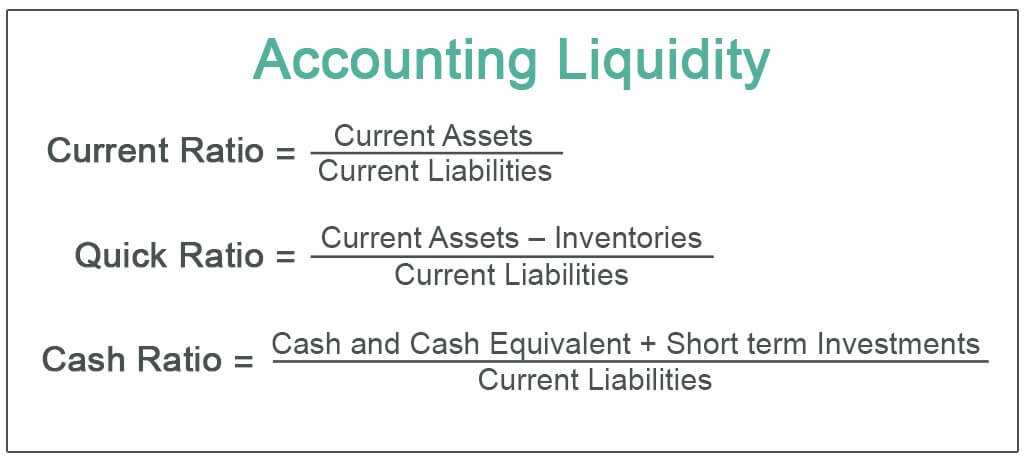

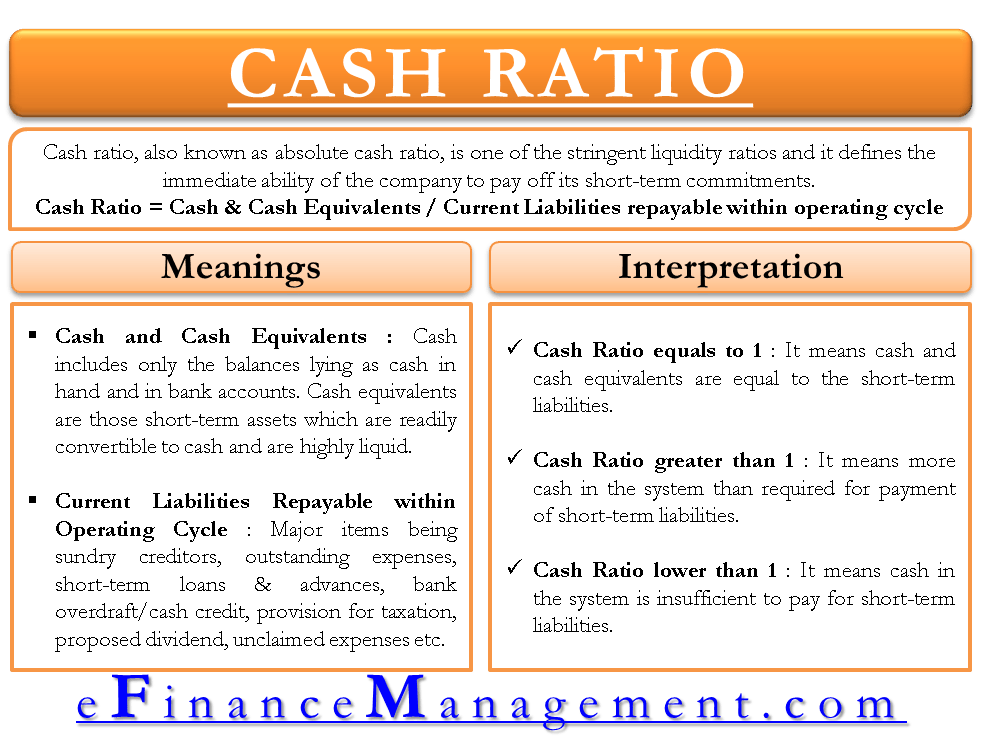

Net liquid assets are a measure of an immediate or near-term liquidity position of a firm calculated as liquid assets less current liabilities. It is calculated as the difference between liquid assets and current liabilities. Current Ratio Current Assets Current Liabilities Note that this formula considers all current assets and current liabilities.

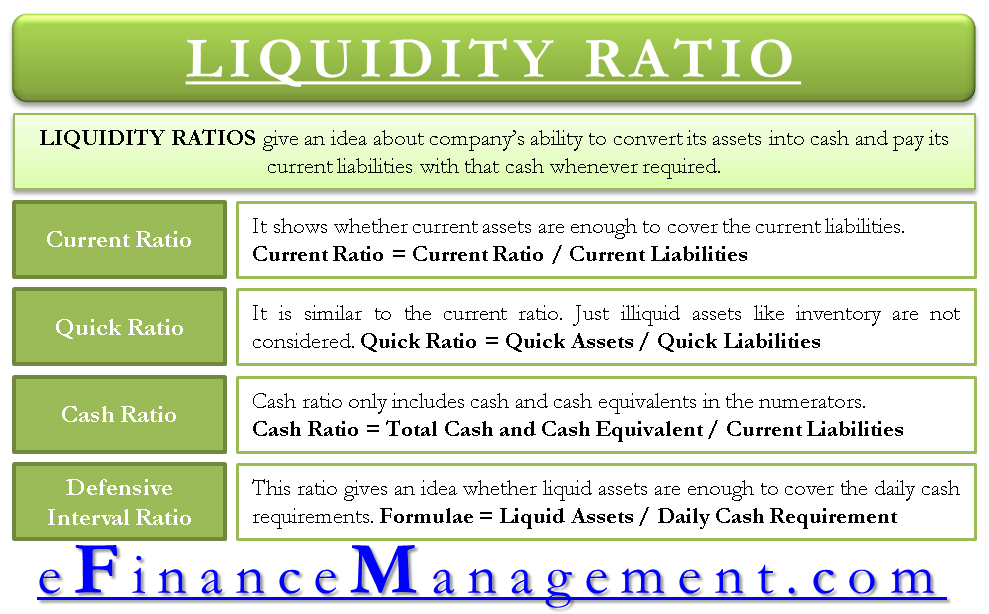

Degree of relative liquidity is determined by looking at the total. A company shows these on the. Importance of Liquidity Ratio.

Current assets are those. It also helps to perceive the short-term financial position. Liquid assets are cash marketable securities and.

Various assets may be considered relevant depending on the analyst. Liquidity ratio helps to understand the cash richness of a company. A financial firms net liquidity position Supplies of liquidity flowing into the financial firm Demands on the financial firm for liquidity The following formula gives a financial firms net liquidity position.

Degree Of Relative Liquidity - DRL. Fundamentally all liquidity ratios measure a firms ability to cover short-term obligations by dividing current assets by current liabilities CL. As a useful financial metric liquidity ratio helps to understand the financial position of a company.