Looking Good Financial Assets At Fair Value Through Profit And Loss

These types of assets have a value that is constantly in flux as a result of changes in the market.

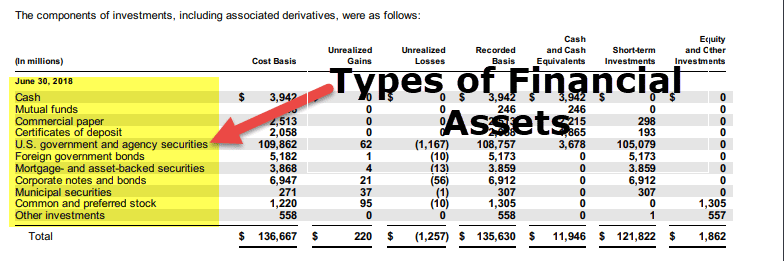

Financial assets at fair value through profit and loss. Any dividend income from the investment in equity instruments is also recorded in the statement of profit or loss. Financial Asset at Fair Value through Profit or Loss. In detail these investments were mainly allocated in the life segment 70341 million which accounted for 965 of this category whereas the residual part referred to the non-life segment 681 million which accounted for 0.

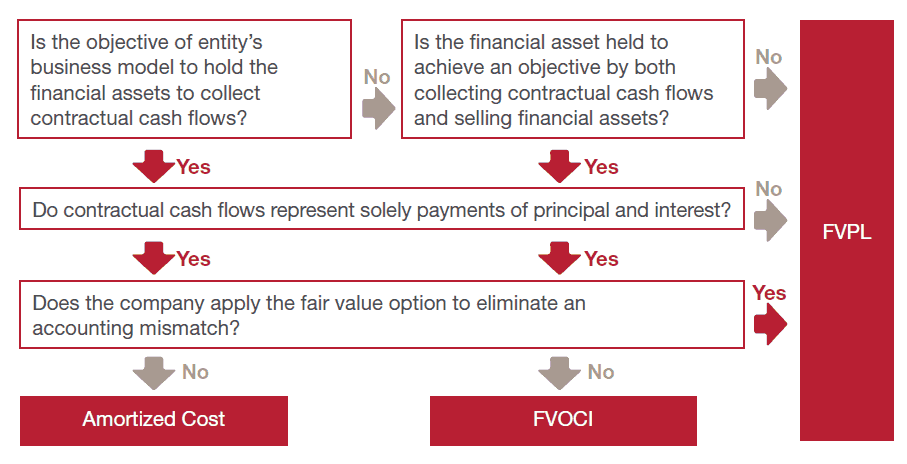

Available-for-sale financial assets are measured at fair value unless a market price or fair value cannot be reliably determined. Under IFRS 9 all financial instruments are initially measured at fair value plus or minus in the case of a financial asset or financial liability not at fair value through profit or loss transaction costs. 15 rows financial assets measured at fair value through profit and loss showing separately those held for trading and those designated at initial recognition.

Fair value through profit or loss is a way of establishing the value of assets and liabilities on a balance sheet. ZLoans and receivables and held to maturity financial assets are measured at amortised cost. Fair value through profit or loss or available for sale categories.

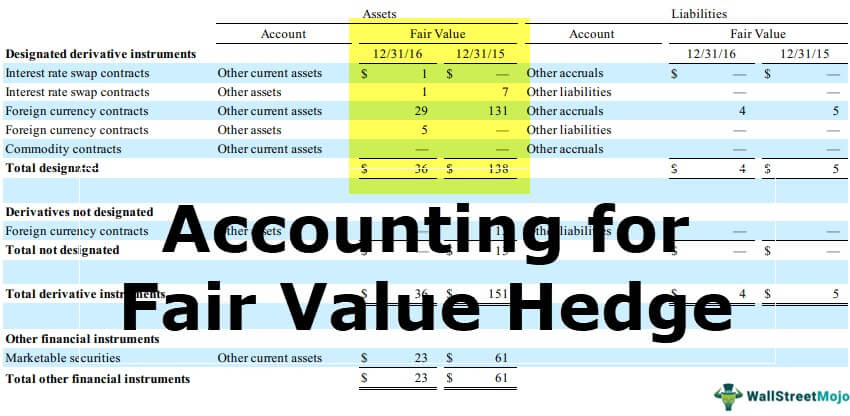

Financial asset at fair value through profit or loss FVTPL is subsequently measured at fair value. It is a valuation method that is particularly used to value financial instruments. This requirement is consistent with IAS 39.

Under IFRS 9 the default financial asset measurement category is fair value through profit or loss FVTPL while under IAS 39 it is available for sale which also requires measurement at fair value but results in less volatility in profit or loss because fair value changes are recognised in other comprehensive income. Financial assets held at fair value through profit or loss comprise assets held for trading and those financial assets designated as being held at fair value through profit or loss. These include financial assets that an entity holds for trading purposes or are recognized at fair value through profit or loss.

When these assets are being held they are always recorded at fair value on the balance sheet and any changes in the fair value are recorded through the income statement eventually affecting net income and not other. Gains and losses on fair valuation are recorded in the statement of profit or loss. This category accounted for 176 of total investments.