Casual Ratios Used For Credit Analysis

A detailed discussion on each of the eight parameters is presented below.

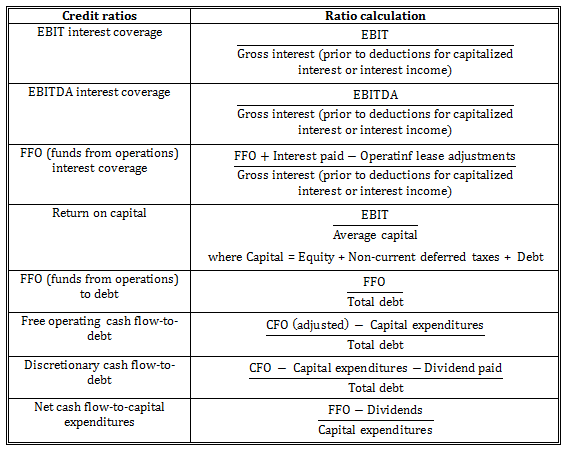

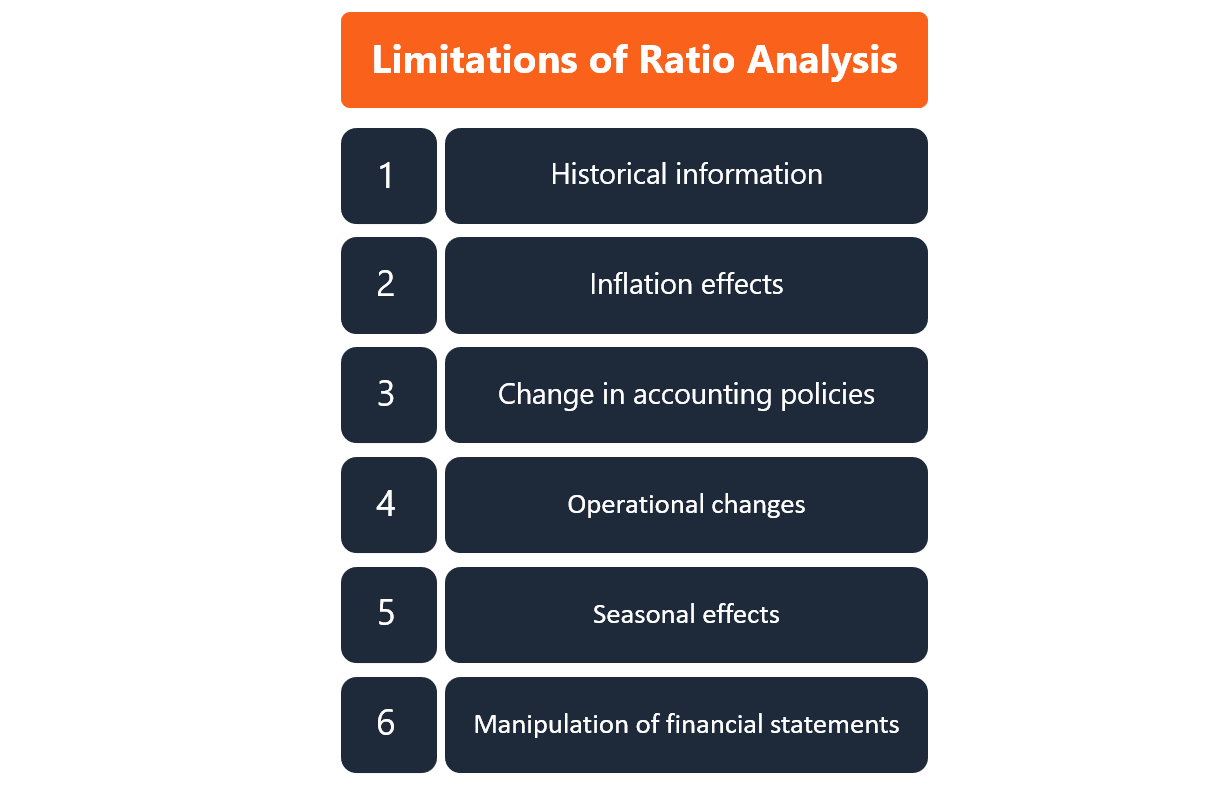

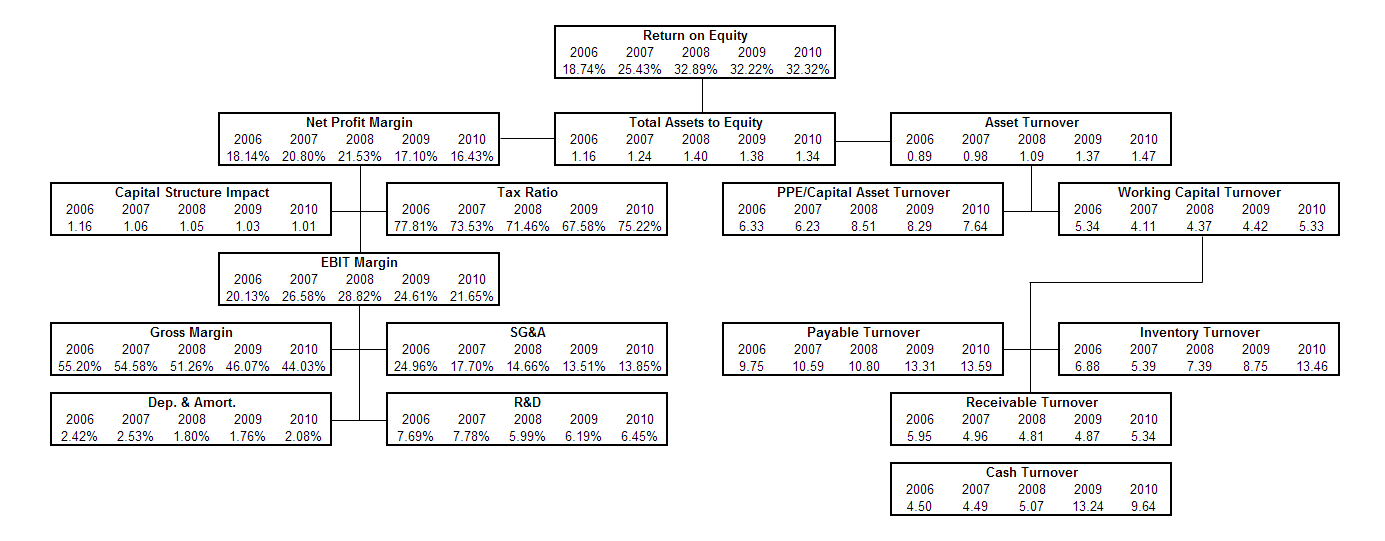

Ratios used for credit analysis. Credit rating agencies often use this leverage ratio. Important Financial Ratios for Credit Analysis Credit analysis covers the area of analyzing the character of the borrowers capacity to use the loan amount condition of capital objectives of taking a loan planning for uses probable repayment schedule so on. Instead CRISIL makes a subjective assessment of the importance of the ratios for each credit.

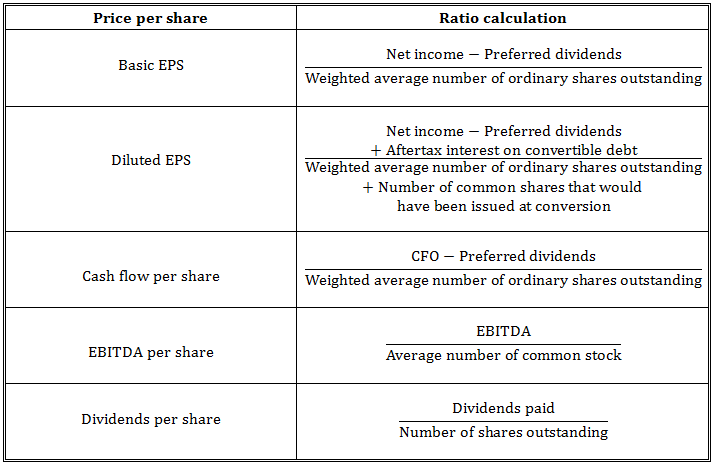

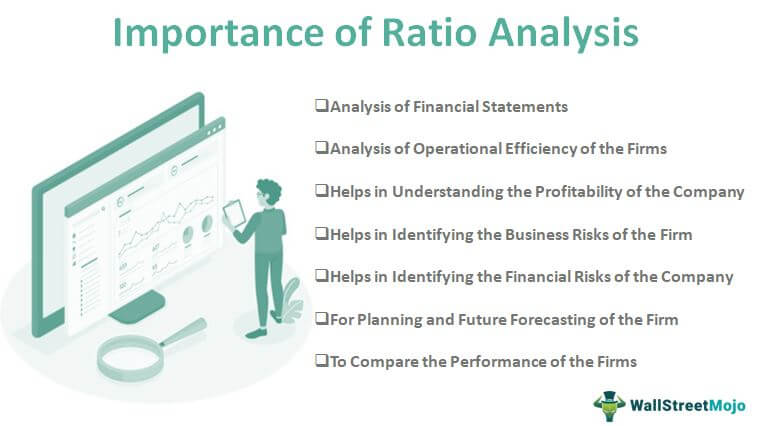

These ratios are used to arrive at the cash generation capacity of the company. Calculate the debt-to-income ratio. The credit analyst compiles this information and synthesize to get a snapshot of risks weaknesses and reinforcing elements strengths of the business opportunity.

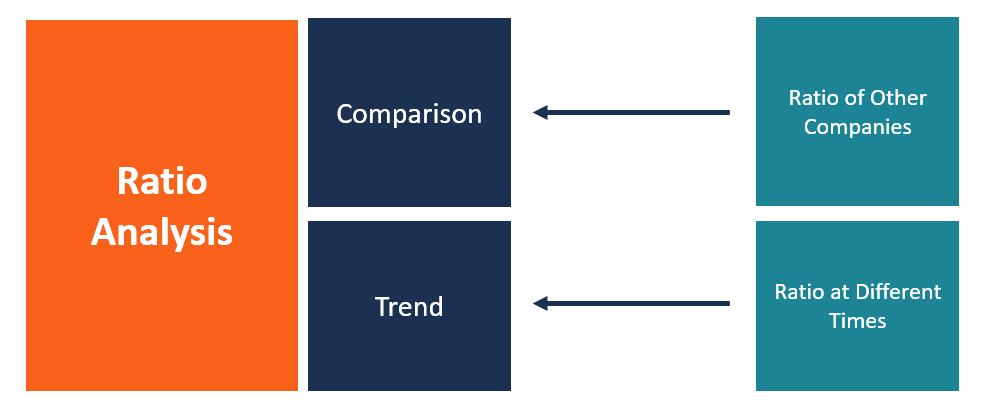

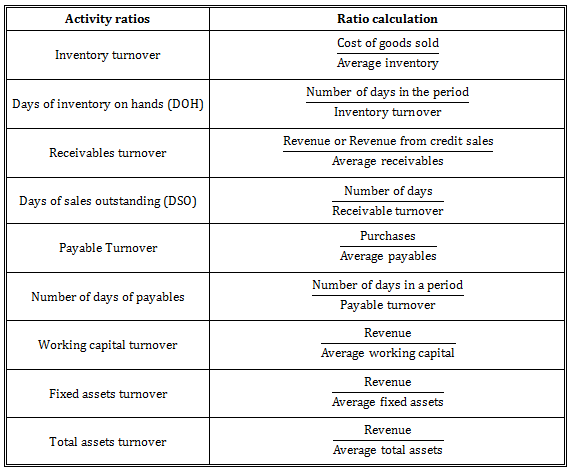

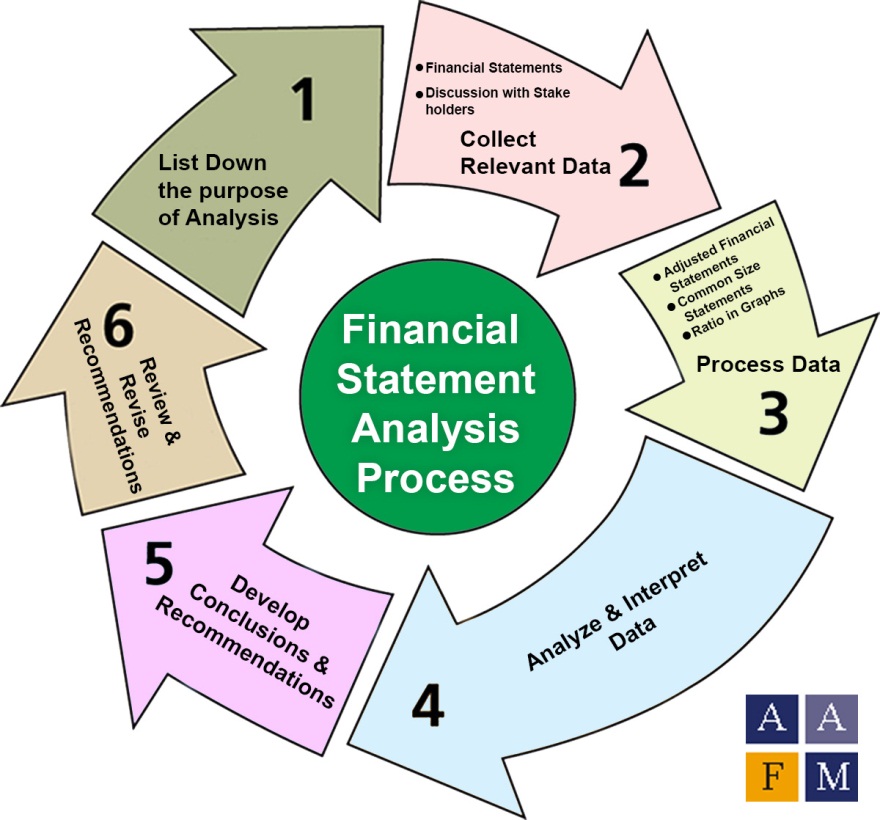

There are several approaches to credit analysis that vary and depend on the purpose of the analysis and the context within which the analysis is being done. Since debt is in the denominator here a higher ratio means a greater ability to pay debts. The accounts receivable turnover ratio measures how many times a company can turn receivables into cash over a given period.

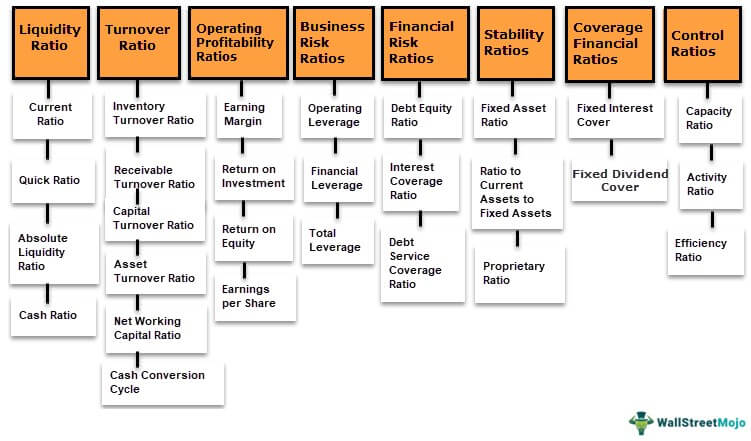

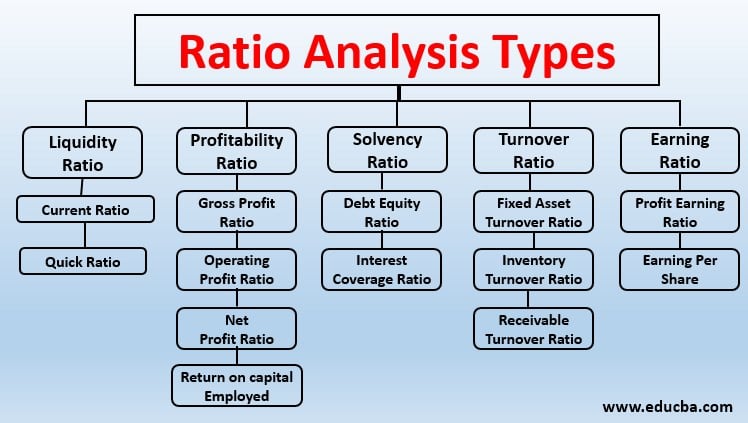

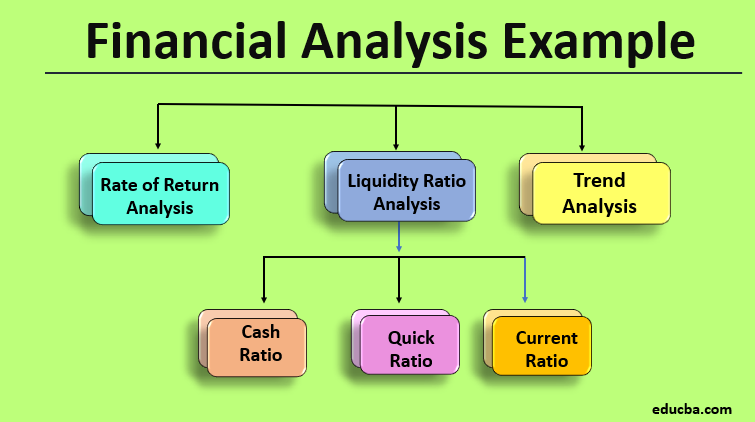

Liquidity ratios These ratios deal with the ability of the company to repay its creditors expenses etc. It goes well beyond it takes into account the entire business environment to determine the risk for the seller to extend credit to the buyer. Analysts consider various ratios and financial instruments to arrive at the true picture of the company.

CRISIL does not adopt an arithmetic approach in using these ratios while assessing financial risk. This is determined by the monthly recurring debts of a company divided by the gross monthly income. We will discuss few ratios which are predominantly used by credit rating analyst or credit rating agencies to gauge solvency and cash flow related aspects of a businesscompany.

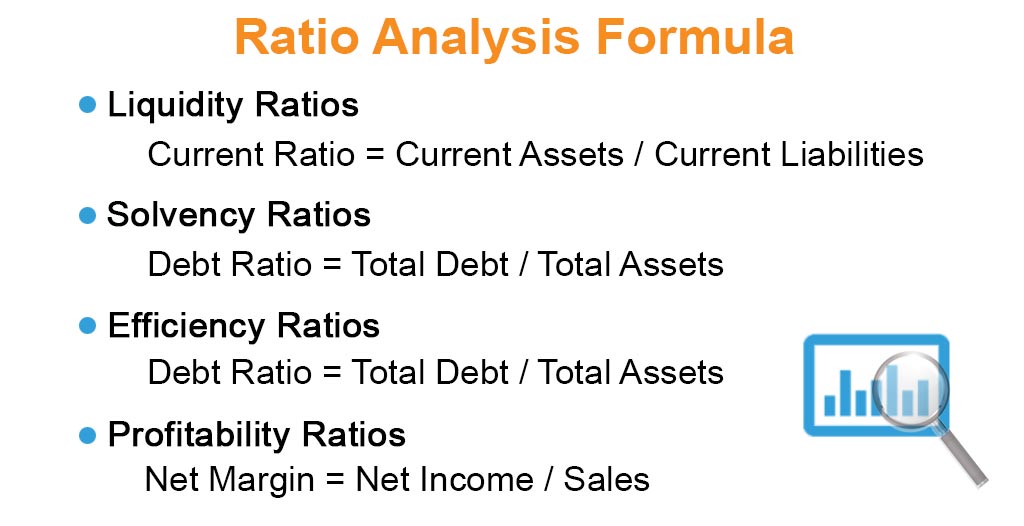

Liquidity refers to the ability of a company to pay. Ratio analysis can be defined as the process of ascertaining the financial ratios that are used for indicating the ongoing financial performance of a company using few types of ratios such as liquidity profitability activity debt market solvency efficiency and coverage ratios and few examples of such ratios are return on equity current ratio quick ratio dividend payout ratio debt. Individuals with a debt-to-income ratio below 35 are considered as acceptable credit risks.