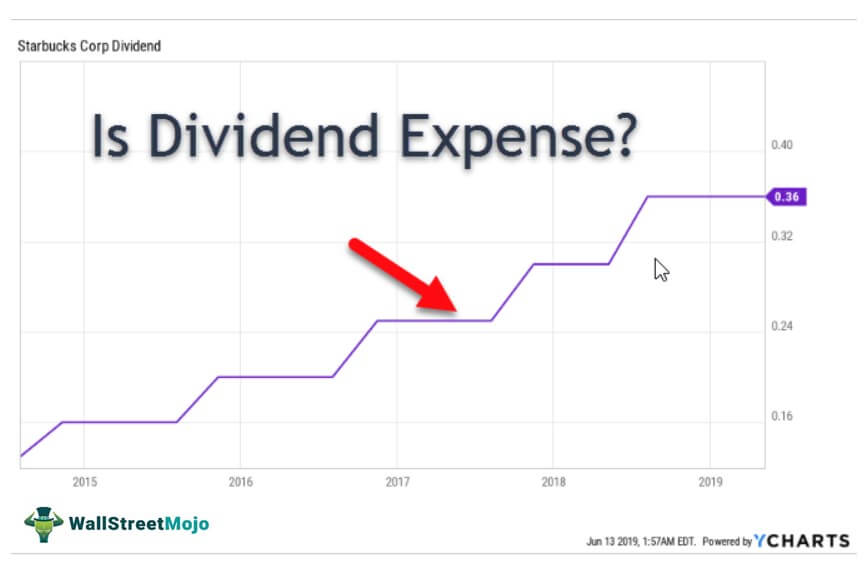

Fantastic Dividends Paid To Stockholders Are A Business Expense

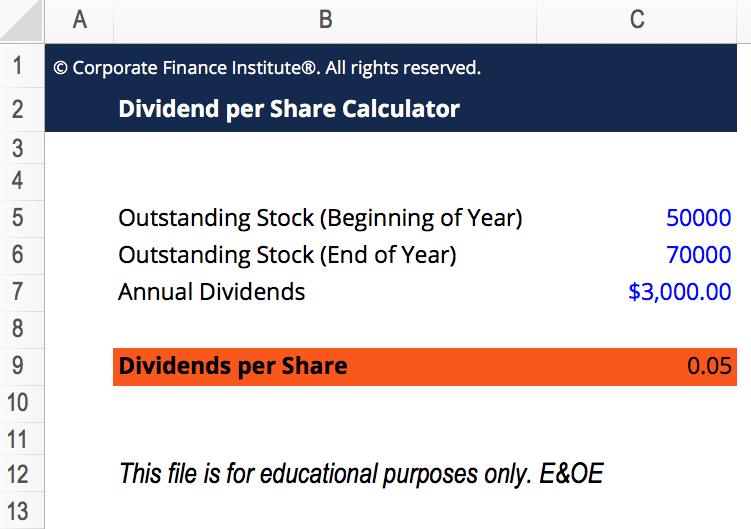

It is therefore the percentage of total earnings paid to the stockholders.

Dividends paid to stockholders are a business expense. Dividends are paid out of the net profits or accumulated reserves of the company which are calculated after deducting all the expenses and paying the corporate income taxes as per the regulatory laws. Buying more assets d. Indicate the effect of each transaction and the balances after each.

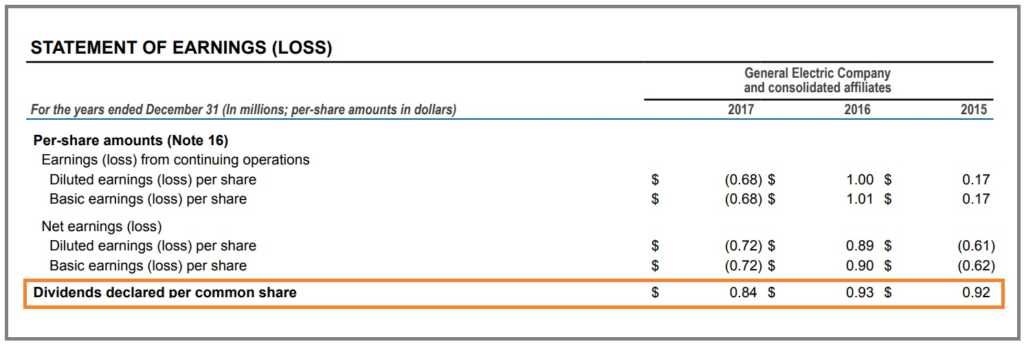

Stock and cash dividends do not affect a companys. Earning revenues in excess of expenses b. Cash dividends are a distribution of part of a corporations earnings that are being paid to its stockholders.

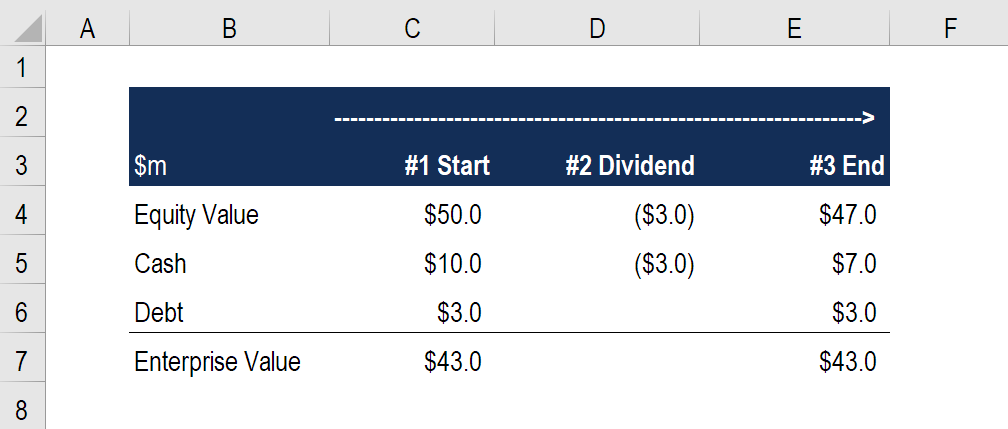

Briefly explain why issuing common stock and revenues increased. Stockholders equity while dividends and expenses decreased. Cash or stock dividends distributed to shareholders are not recorded as an expense on a companys income statement.

Definition of Dividend Payment to Stockholders A dividend payment to stockholders is usually a cash payment which reduces the corporations asset cash and the corporations stockholders equity. Even if the expenditure is not a constructive dividend it will be deductible only if the taxpayer can prove it is an ordinary and necessary expense. Dividends are taxable to a corporation as they represent a companys profits.

Some examples are CPF contributions wages renovation advertising etc. Dividends paid to stockholders are a tax-deductible business expense. If the shareholder is the primary beneficiary of the payment as was so in this case the IRS will reclassify it as a constructive dividend and deny the corporation a deduction.

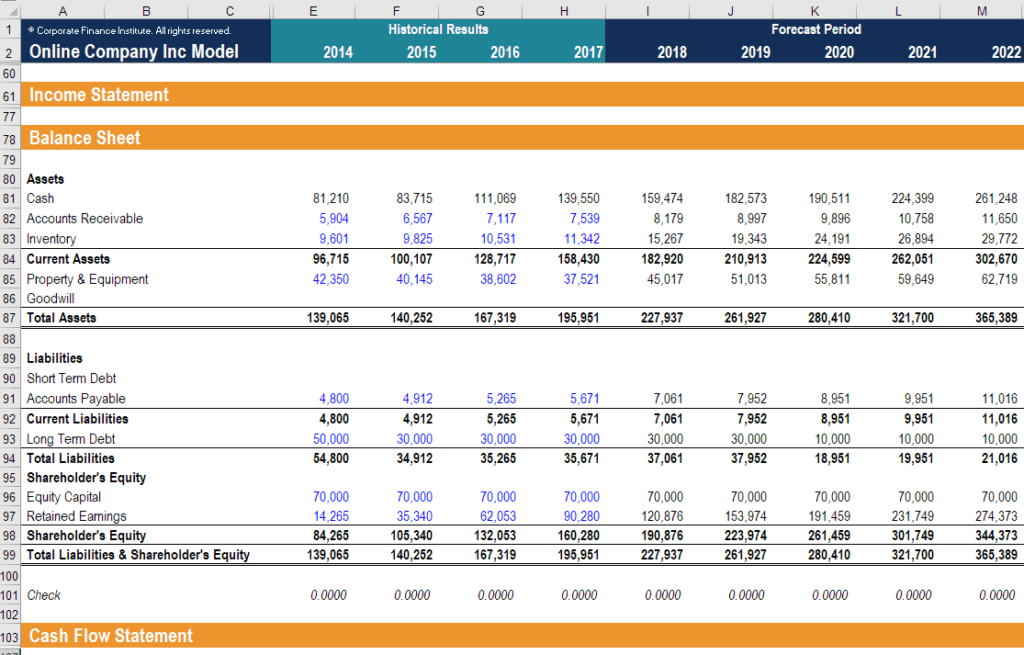

Since repayments of loans to the business also go under this section cash flow from financing activities it seems logical to include dividends paid to investors. A business improves stockholders equity by _____. There are actually two steps required for a corporation to make a dividend payment.

/WallStreetQuietPeriod-565aa9df5f9b5835e468930e.jpg)