Recommendation Common Size Statement Of Profit And Loss Contingent Liabilities In Balance Sheet Example

Inventory Inventory is a current asset.

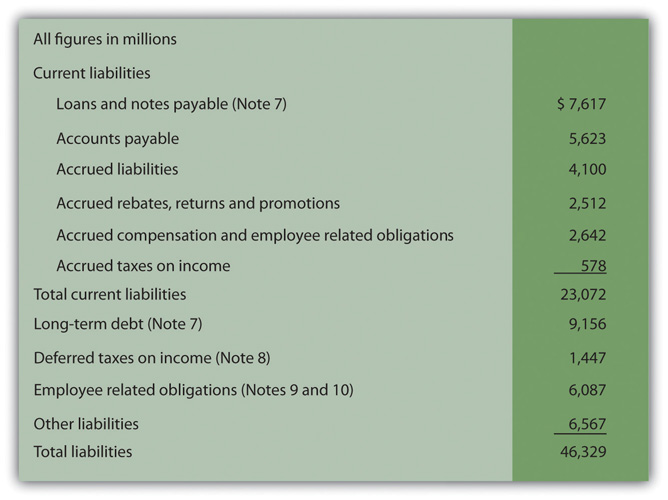

Common size statement of profit and loss contingent liabilities in balance sheet example. Examples of Contingent Liabilities. A It is probable that future events will confirm that after taking into account any related probable recovery an asset has been impaired or a liability has been incurred as at the balance sheet date and. A loss contingency which is possible but not probable will not be recorded in the accounts.

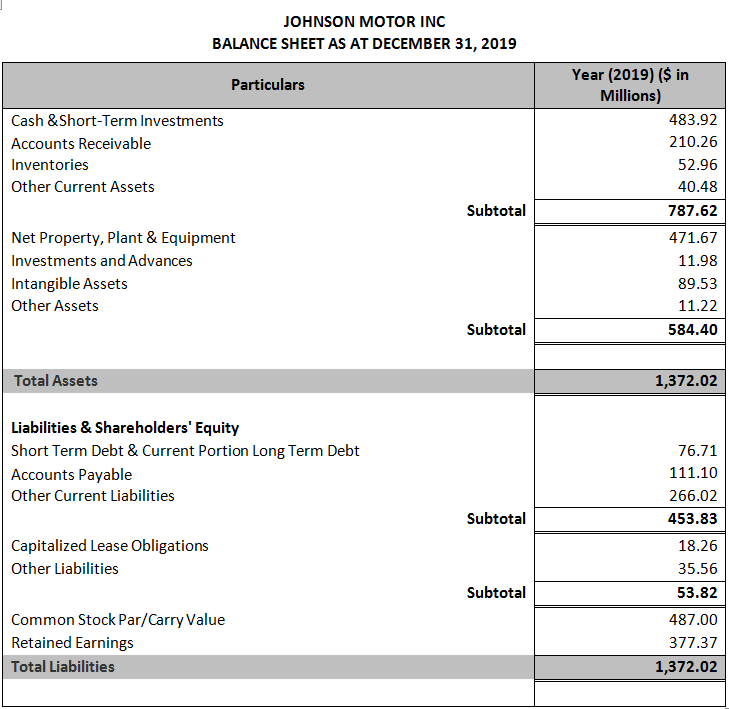

Example of a Common Size Balance Sheet A company has 8 million in total assets 5 million in total liabilities and 3 million in total equity. The financial statements of different companies belonging to the same group are consolidated to present the financial position as a whole. Common size analysis can be conducted in two ways ie vertical analysis and horizontal analysis.

The company has 1 million in cash which is part. Contingencies can be included on the balance sheet as a liability if certain requirements are met. Potential liability of company which depends on the happening or non-happening of some contingent event in the future which is beyond the companys control of company is known as the contingent liability and the example of which includes potential pending lawsuits of the company warranties given etc.

A To establish relationship between revenue from operations and other items of statement of profit loss. Financial Statements and ITC detailed profit and loss accounts. Assets Liabilities Owners Equity.

Just insert the respective amounts in the cells and it will automatically calculate profit or loss for your company. The common figure for a common size balance sheet analysis is total assets. This equation showcases the amount business owns in the form of.

It is called a balance sheet because it. If your Operating Earnings change from 2105244 to 2344333 that might not tell you much by itself because other numbers might have changed as well. Manually preparing a consolidated balance sheet involves several steps right from arriving at the share capital profits.

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)