Fantastic Current Ratio Interpretation Between Two Years

Given working capital is 45000.

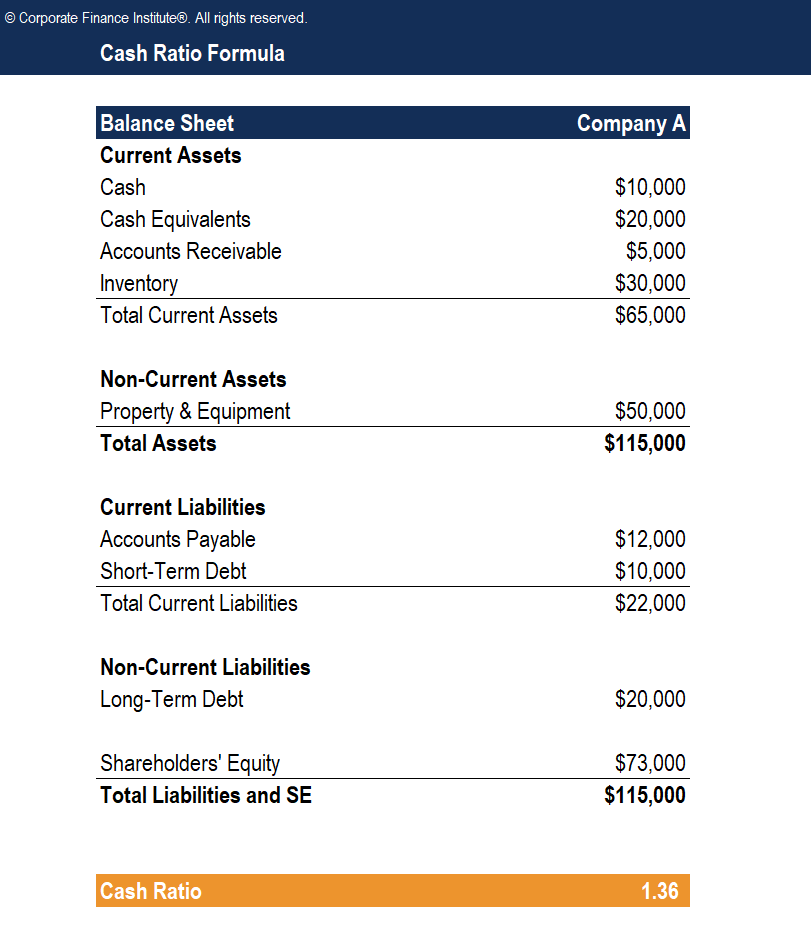

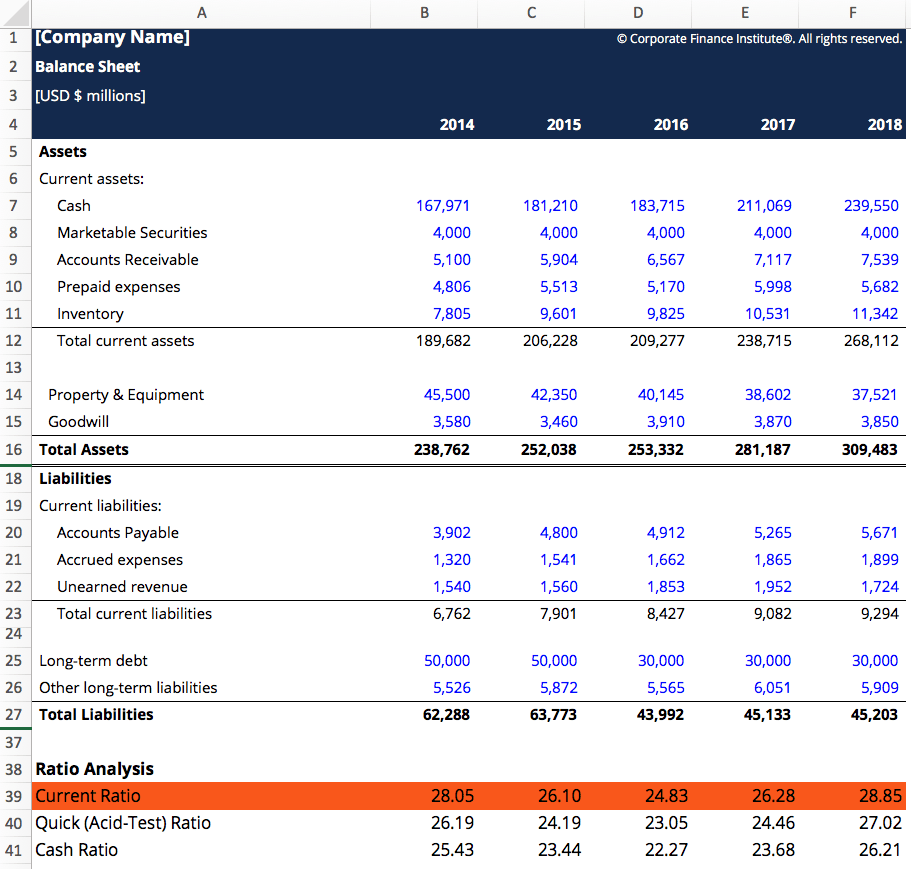

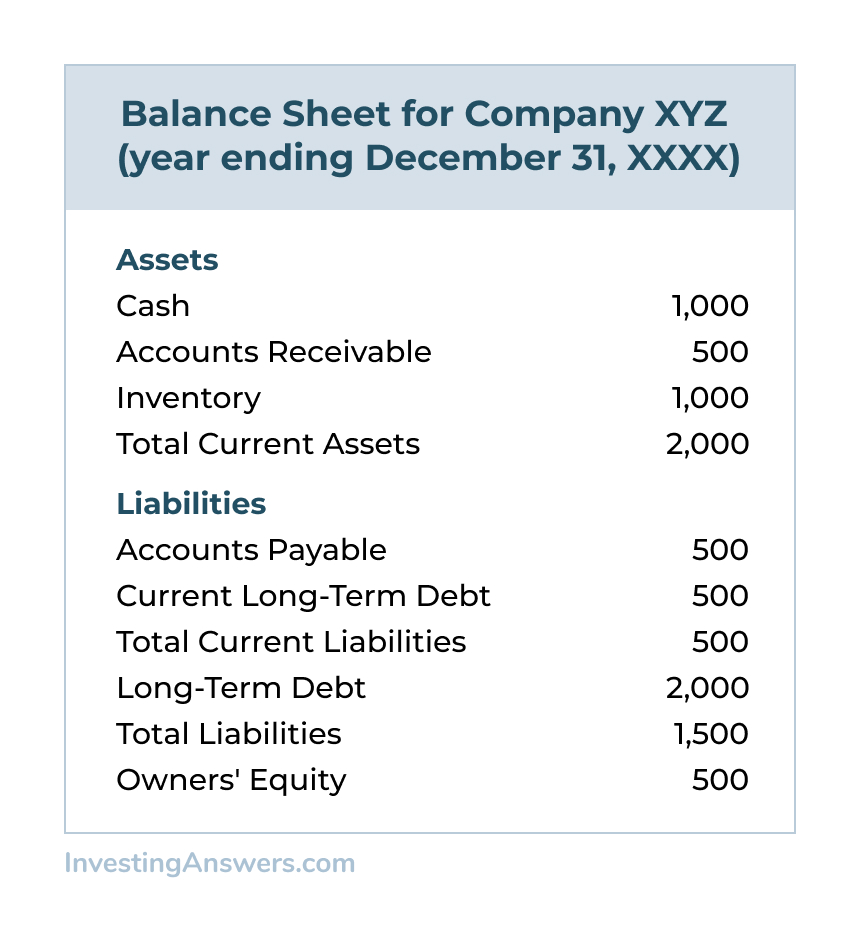

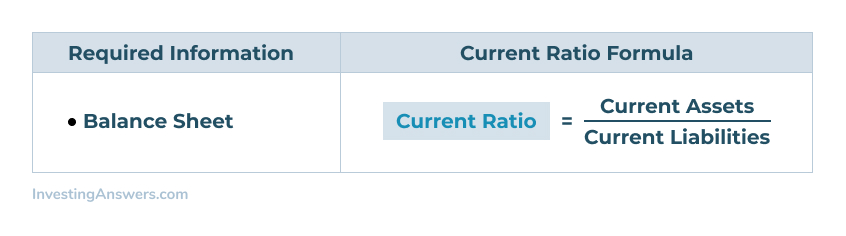

Current ratio interpretation between two years. Current liabilities Current liabilities You should note that this ratio is not expressed as a percentage. Current ratio is a financial ratio that measures whether or not a company has enough resources to pay its debt over the next business cycle usually 12 months by comparing firms current assets to its current liabilities. Current ratio can be defined as a liquidity ratio that measures a companys ability to pay short-term obligations.

Compare NKE With Other Stocks. Current ratio 25 Inventory 40000. The current ratio is calculated by dividing a companys current assets by its current liabilities.

The current ratio reveals how much cover the business has for every 1 that is owed by the firm. How many dollars in current assets are there to cover each dollar in current liabilities. A high ratio implies that.

The current ratio also known as the working capital ratio measures the capability of a business to meet its short-term obligations that are due within a year. Answer to Example 2. The current ratio is the classic measure of liquidity.

You are required to calculate and interpret a quick ratio. Woolworths Limited Assignment Topic Evaluate the performance of a company through critical analysis of its published financial statements over the two latest years as follows. The current ratio shows how many times over the firm can pay its current debt obligations based on its assets.

The current ratio is a liquidity ratio that indicates a companys capacity to repay short-term loans that are due within the next year. Market Ratios PriceEarning Ratio. Current ratio also known as the working capital ratio The formula for calculating this ratio is Current assets OR Current assets.

/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

/calculator-385506_19202-56a1793ca018481dbe9bb52cba129f33.jpg)