Cool Bad Debts In Cost Sheet

Example of Bad Debt Expense.

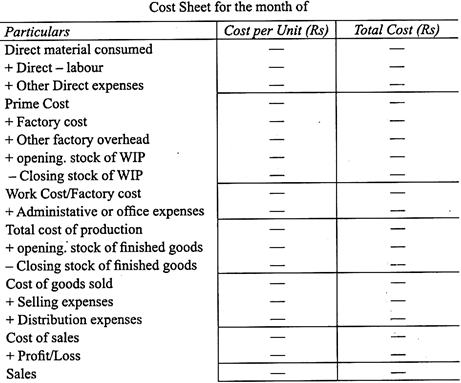

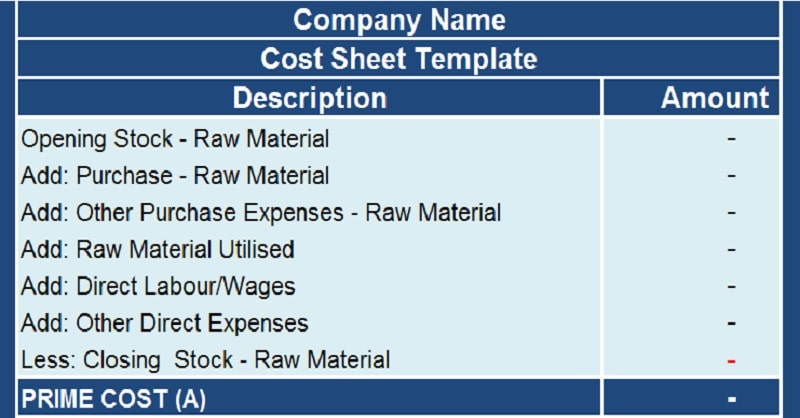

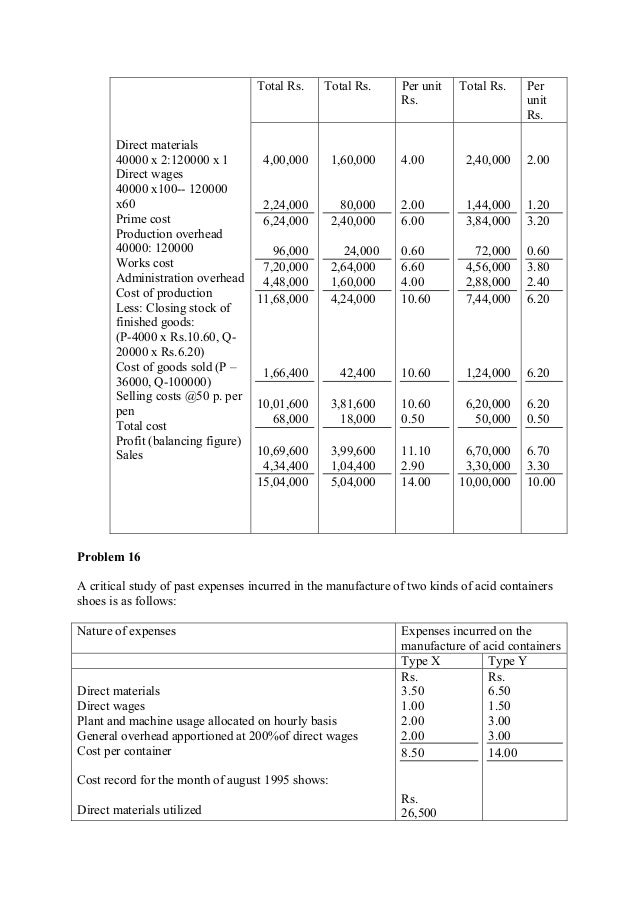

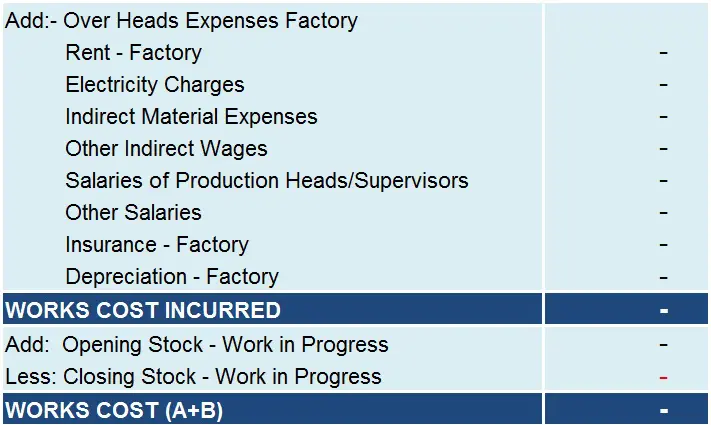

Bad debts in cost sheet. Bad debts written off in cost sheet. 18 October 2018 What is the treatment of bad debts written off in cost sheet. Bad debts expense results because a company delivered goods or services on credit and the customer did not pay the amount owed.

During the year debts written off amounted to Rs. Its recorded in the financial statements as a provision for credit losses. When a company decides to leave it out they overstate their assets and they could even overstate their net income.

Revenue belongs on the Income Statement and Accounts Receivable belong on the Balance SheetStatement of Financial Position. Bad Debt Recovered Income 300. Presentation of Bad Debt Expense.

Based on past experience and its credit policy the company estimate that 2 of credit sales which is USD 1900 will be uncollectible. 2 X 300000 6000. Percentage of bad debt 20000 300000 Percentage of bad debt 667 If 667 sounds like a reasonable estimate for future uncollectible accounts you would then create an allowance for bad debts equal to 667 of this years projected credit sales.

Similarly bad debts will also be shown in profit loss ac. This Bad Debts Expense account will be shown separately under Operating Expenses on the Income Statement. There are two distinct ways of calculating bad debt expenses the direct write-off method and the allowance method.

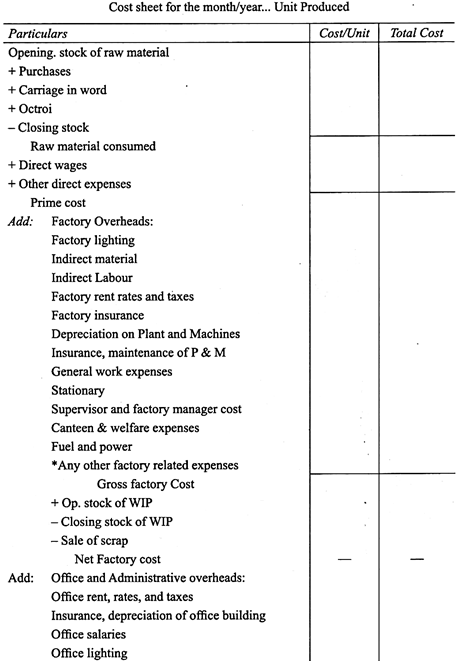

The bad debts are the losses that the business suffers because it did not receive immediate payment for the sold goods and provided services. Hi there are different-2 arguments regarding the treatment of Bad debtsAccording to some authors it should be treated as selling and distribution exp but according to other it should not treated as selling. Bad Debts form a part on the debit side in the Income Statement as an Expense.