Matchless Difference Between Pre Closing And Post Closing Trial Balance

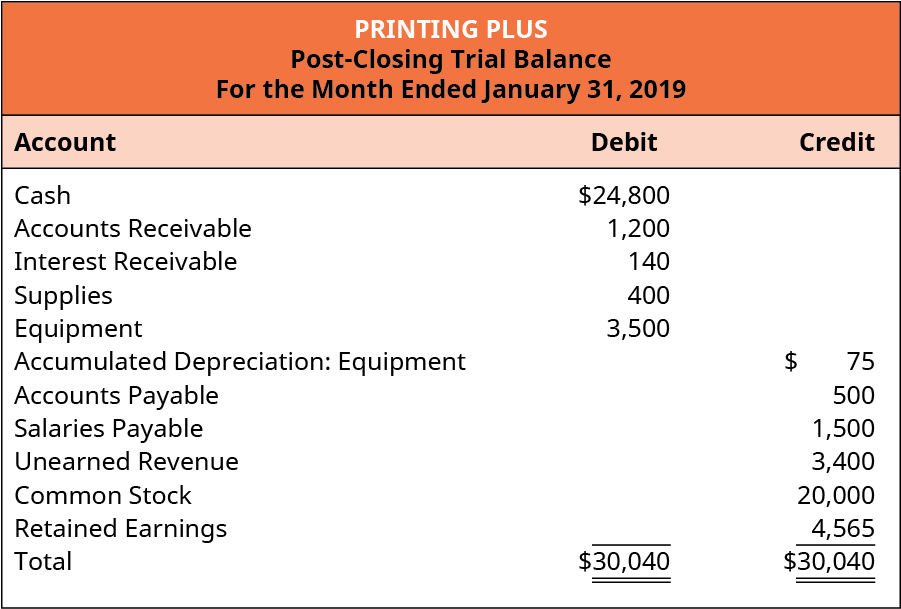

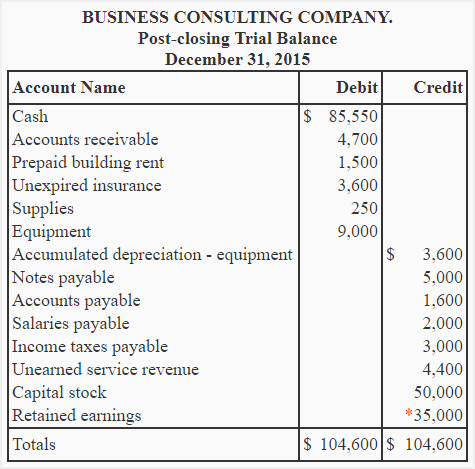

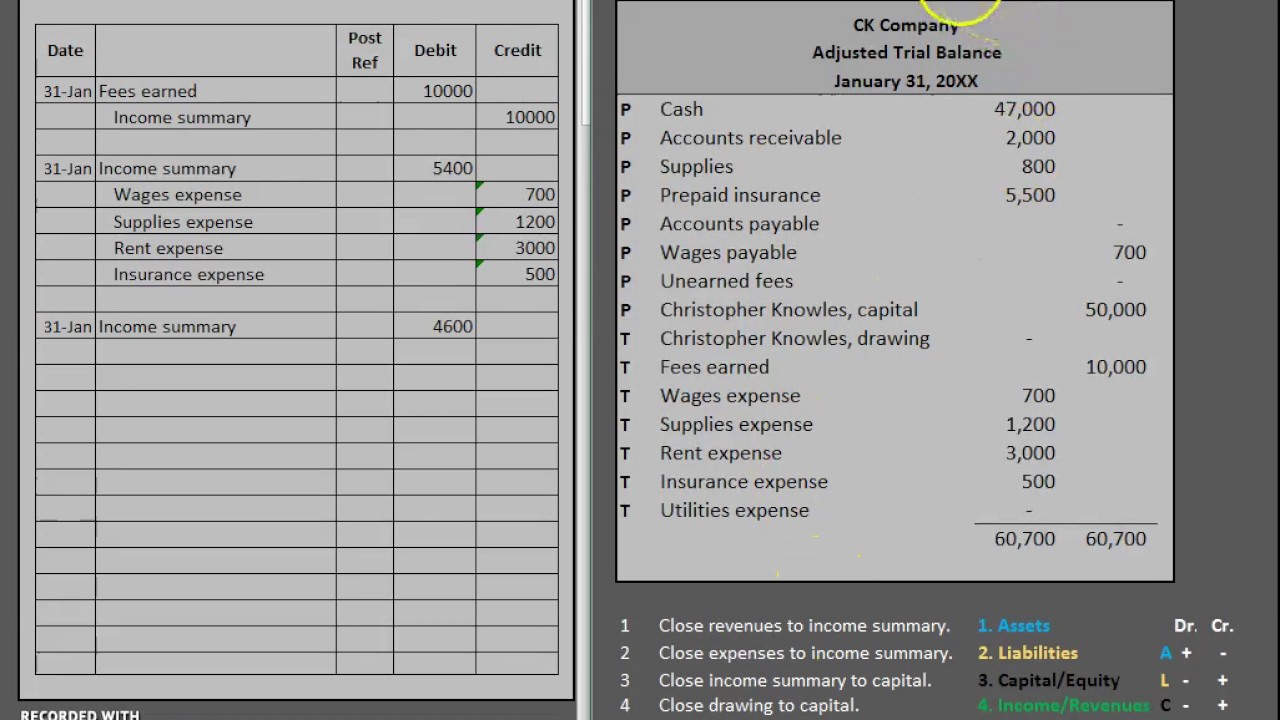

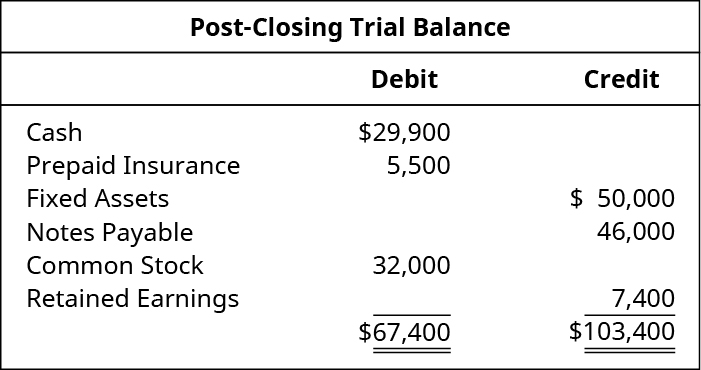

Since closing entries close all temporary ledger accounts the post-closing trial balance consists of only permanent ledger accounts ie.

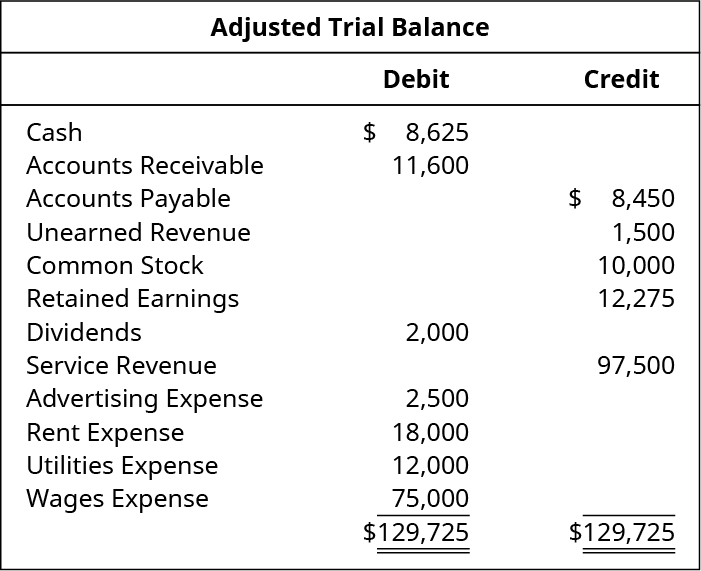

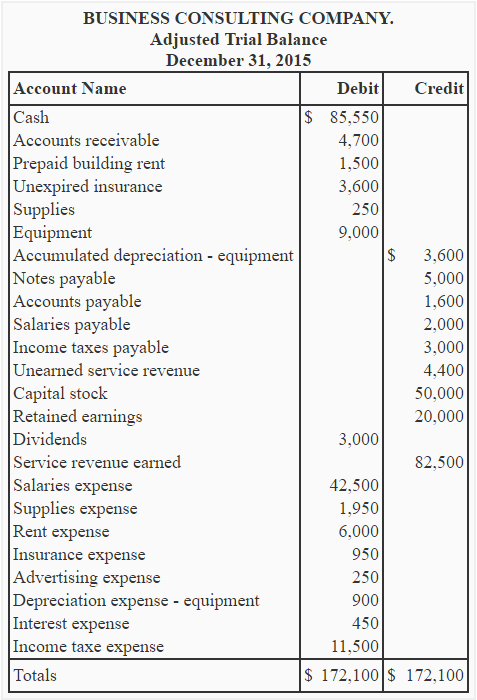

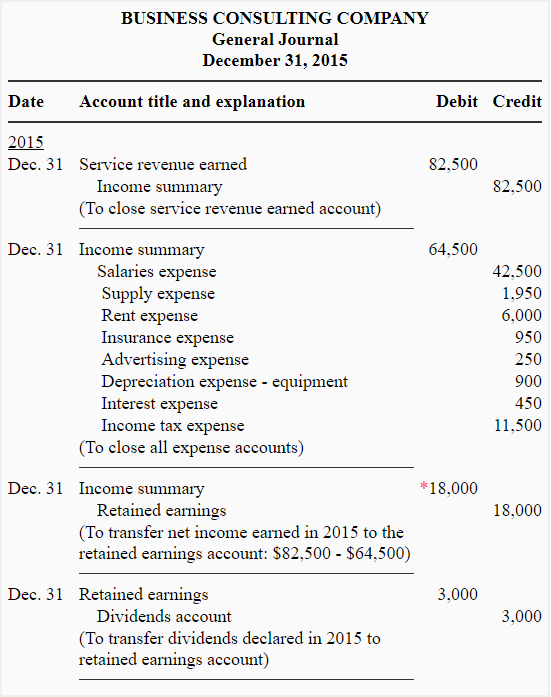

Difference between pre closing and post closing trial balance. Ad Easily Create Your Trial Balance Just Fill-in the Blanks Print. The main change from an adjusted trial balance is revenues expenses and dividends are all zero and their balances have been rolled into retained earnings. If we compare a Pre-Closing Trial Balancewith a Post-Closing Trial Balancewe will clearly see that although the revenue expense and drawings accounts do not appear on the Post-Closing Trial Balance the value of owners equity has not changed.

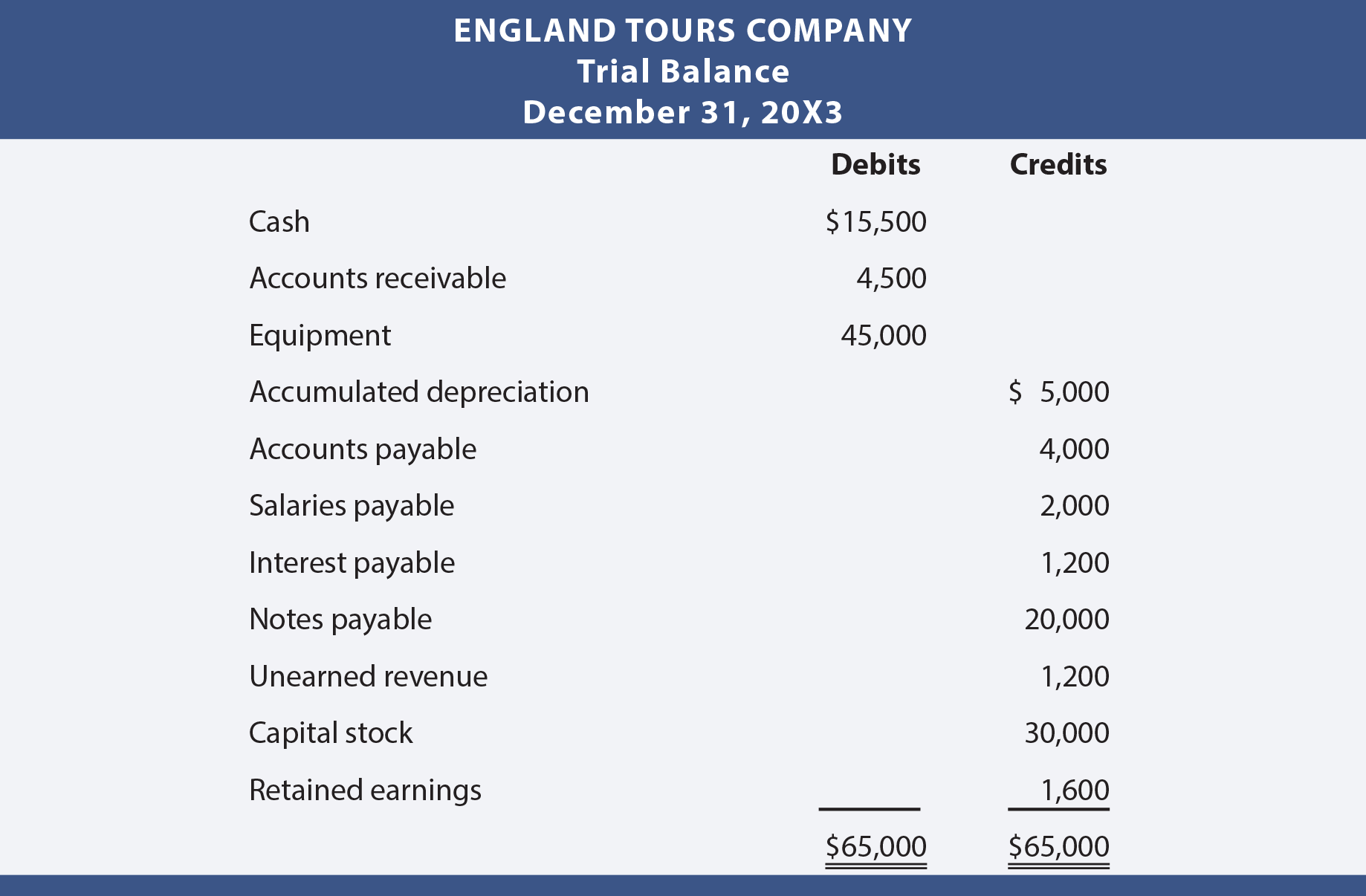

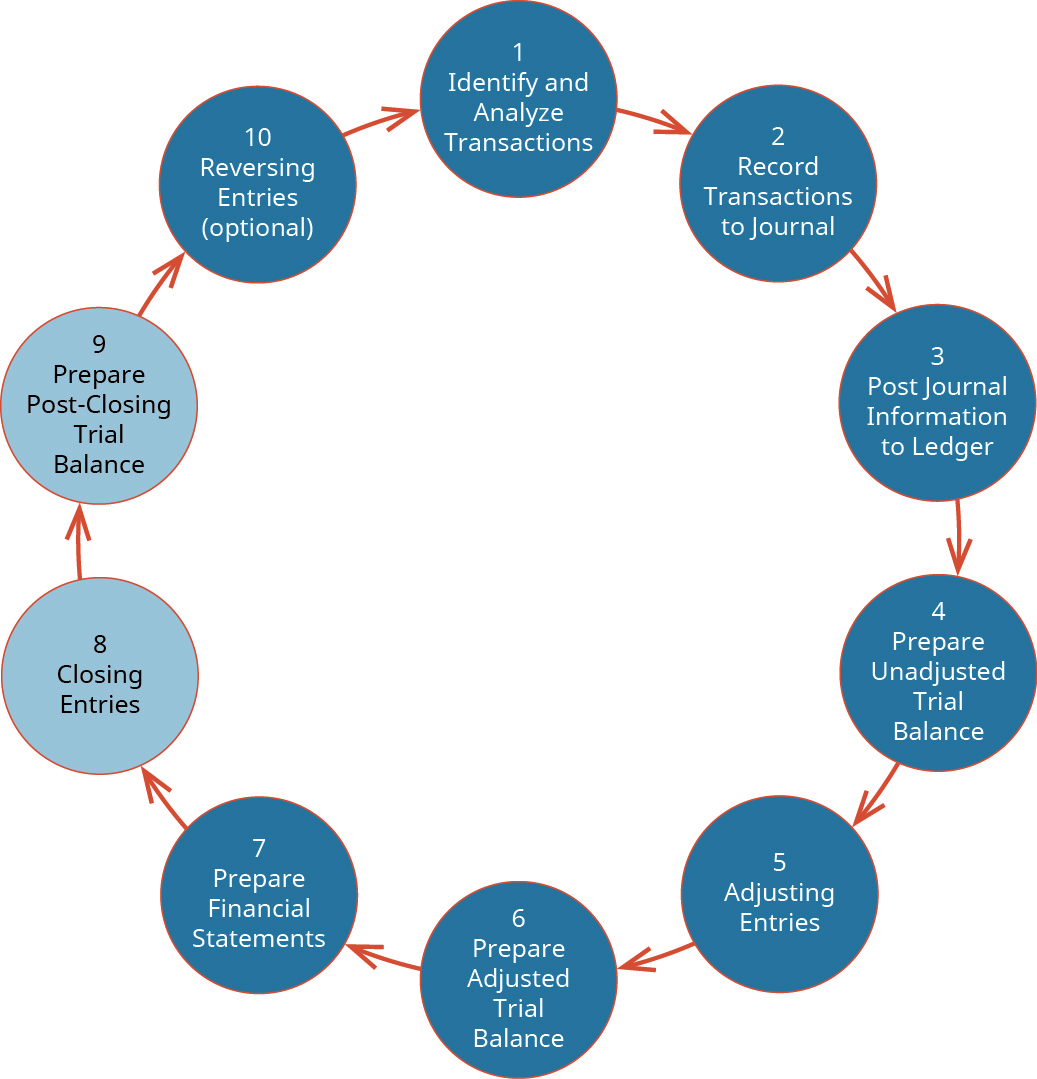

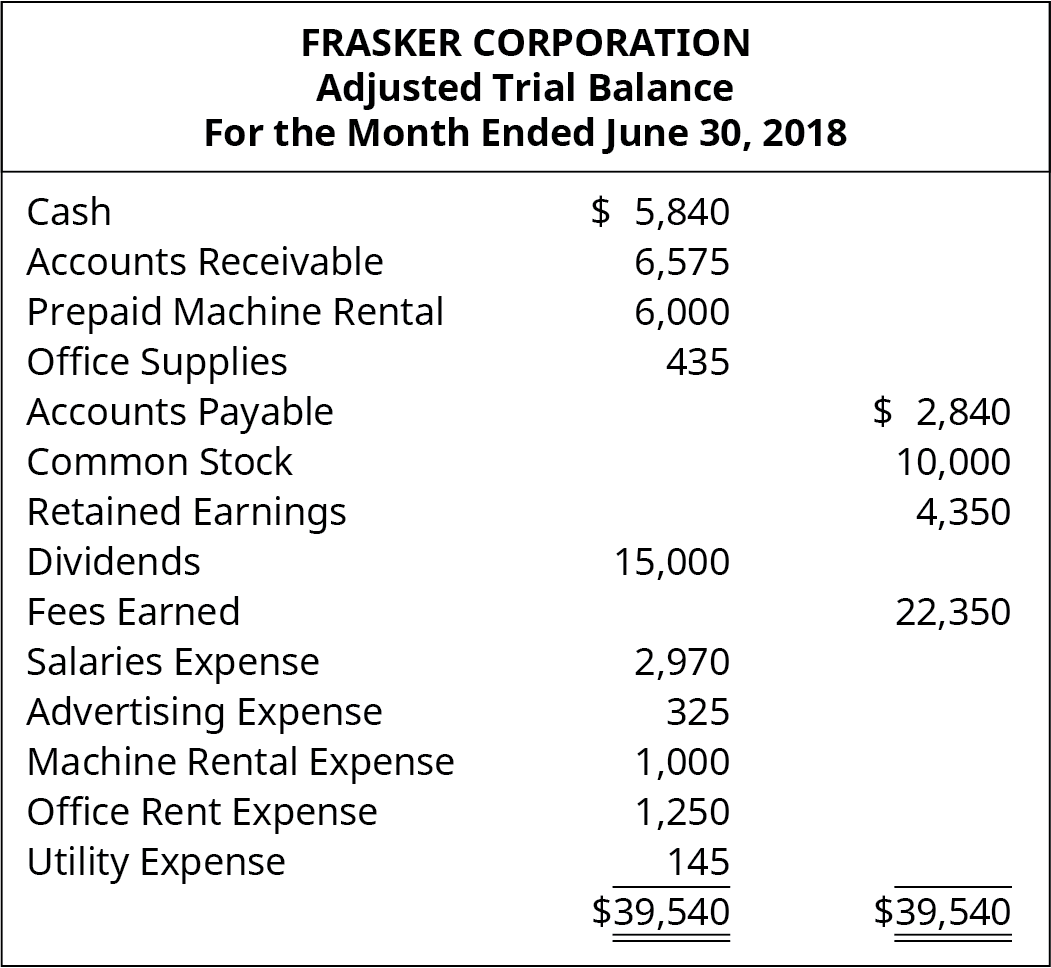

Post closing trial balance is made before making balance sheet. If playback doesnt begin shortly try restarting your device. The unadjusted and adjusted trial balances are not part of the accounting cycle.

The post-closing trial balance is prepared to verify the equality of debits and credits. The main difference between post-closing trial balance and adjusted trial balance is that this statement contains the income statement accounts like revenues expenses and other gain or lost accounts. Post closing trial balance is simply the finalized financial statements balance sheet and income statement in trial balance format.

The unadjusted and adjusted trial balances are optional reports. Net profit from income statement will increase the capital balance in post-closing trial balance. Completed after closing entries the post-closing trial balance prepares your accounts for.

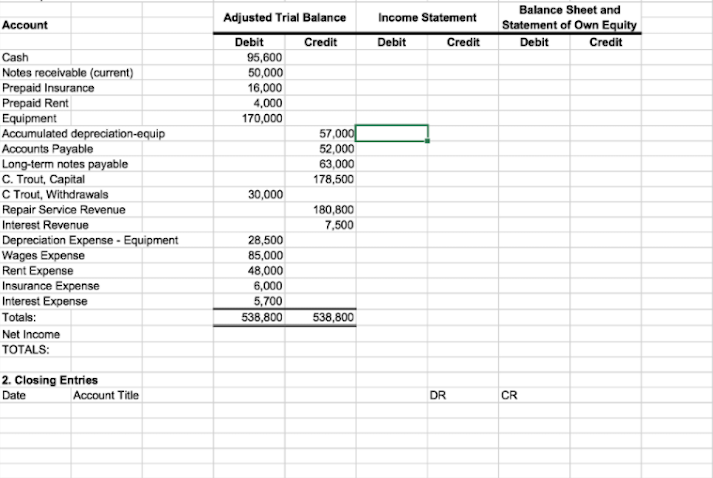

We do not include income and expenses accounts balances in post closing trial balance. Initially the accountant prepares a trial balance without adjusting entries then subtracts or adds adjusting entry totals and creates an adjusted trial balance. Whereas the difference between an adjusted trial balance and a post-closing trial balance is the closing entries that are required to close off the temporary.

The unadjusted and adjusted trial balances are optional reports. The trial balance shows the ending balances of all asset liability and equity accounts remaining. When we make income statement after adjusted trial balance balance we can make post closing trial balance.