Formidable Statement Of Functional Expenses Required

Other private nonprofit organizations are encouraged to disclose this information but they are not required to.

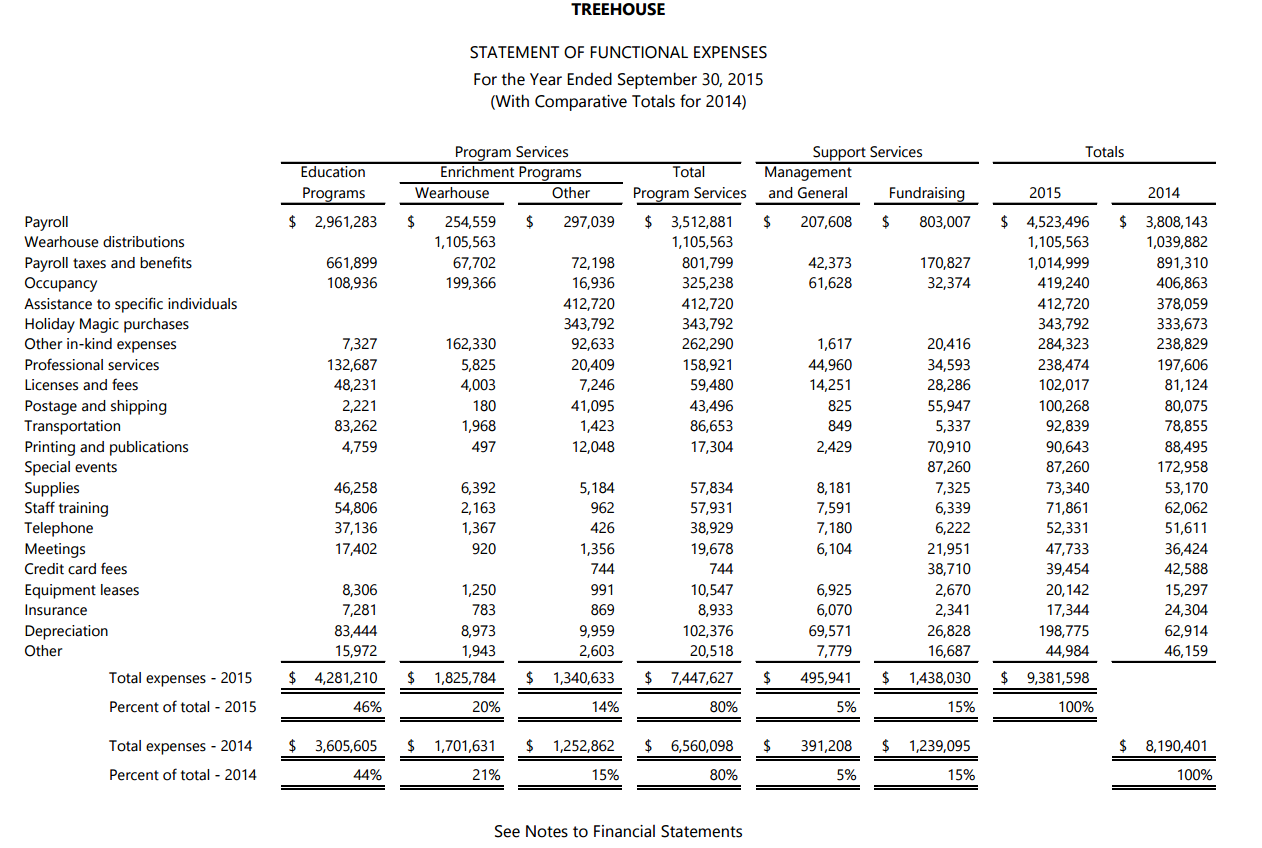

Statement of functional expenses required. C According to FASB ASC 958 a statement of functional expenses is required for voluntary health and welfare organizations. Such organizations are currently required to present a statement of functional expenses that displays a matrix of expenses by both functional and natural categories. Functional categories include fundraising and management and general as well as individual.

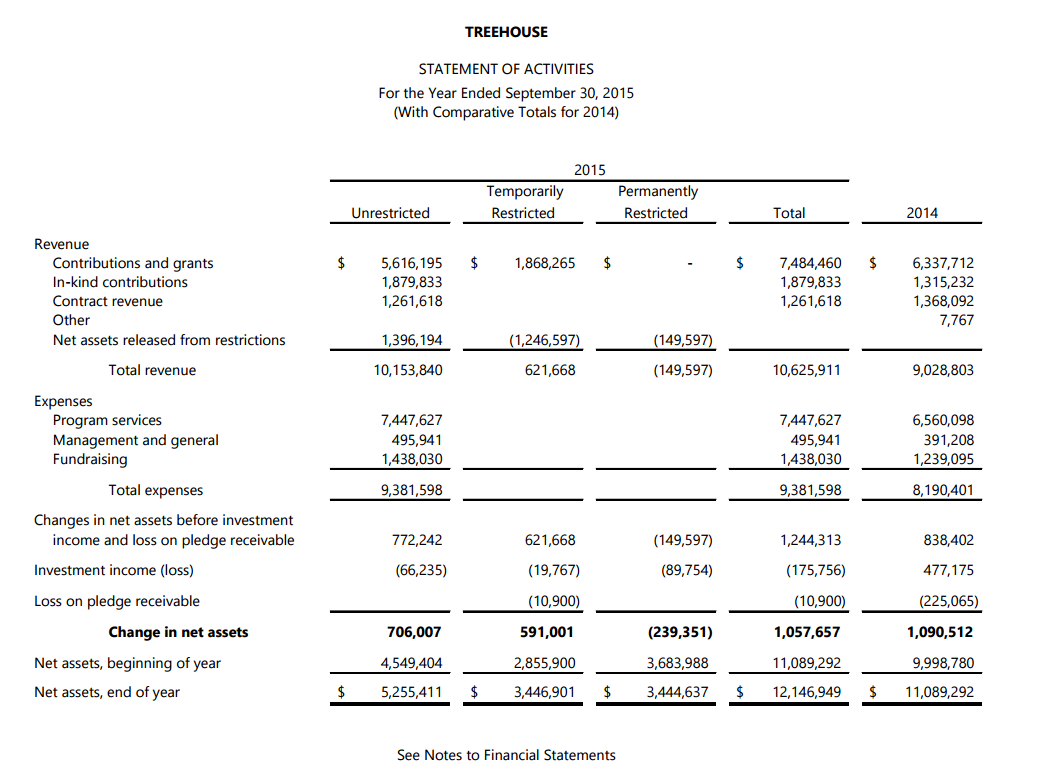

With Odoo Expenses youll always have a clear overview of your teams expenses. Nonprofit accounting differs from business accounting because nonprofits dont exist to make profits. Statement of Functional Expenses The statement of functional expenses is described as a matrix since it reports expenses by their function programs management and general fundraising and by the nature or type of expense salaries rent.

All nonprofit organizations will be required to present information on their expenses. Ad Managing your expenses has never been easier. Validate or refuse with just one click.

For instructional purposes we highlighted the column headings to indicate the expenses by function. This means that you have to break out all of your expenses into a functional allocation of expenses. STATEMENT OF FUNCTIONAL EXPENSE INSTRUCTIONS In General All organizations who complete the IRS Form 990 N post card 990-EZ 990-PF or who do not complete any 990 must complete the Statement of Functional Expense Form.

The amount of time needed to implement this element depends on whether the organization files Form 990 Return of Organization Exempt From Income Tax. For some not-for-profit entities NFPs a separate statement of functional expenses will be the most efficient and effective way of presenting the analysis of expenses by function and nature that is required under FASB Accounting Standards Update ASU 2016-14 Not-for-Profit Entities Topic 958. All nonprofit organizations are required to report information about expenses by their functional classification on their financial statements in either the statement of activities or in the notes to the financial statements.

With FASBs issuance of Accounting Standards Update ASU 2016-14 Not-for-Profit Entities Topic 958. Presentation of Financial Statements of Not-for-Profit Entities. It used to be that only certain organizations were required to have a statement of functional expenses but now all non-profits are required to have a statement of functional expenses.