Smart Pro Forma Statements Are Used For

You may be wondering what is a pro forma income statement.

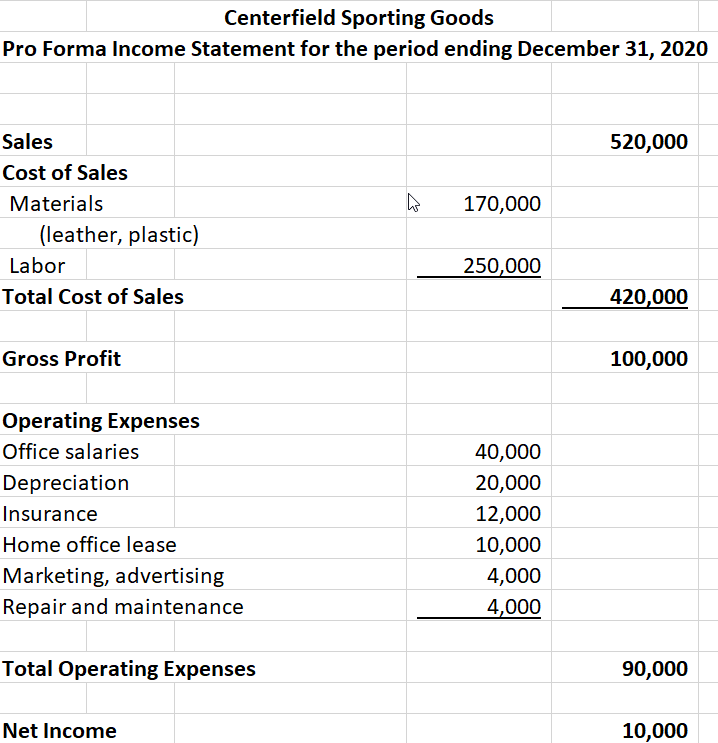

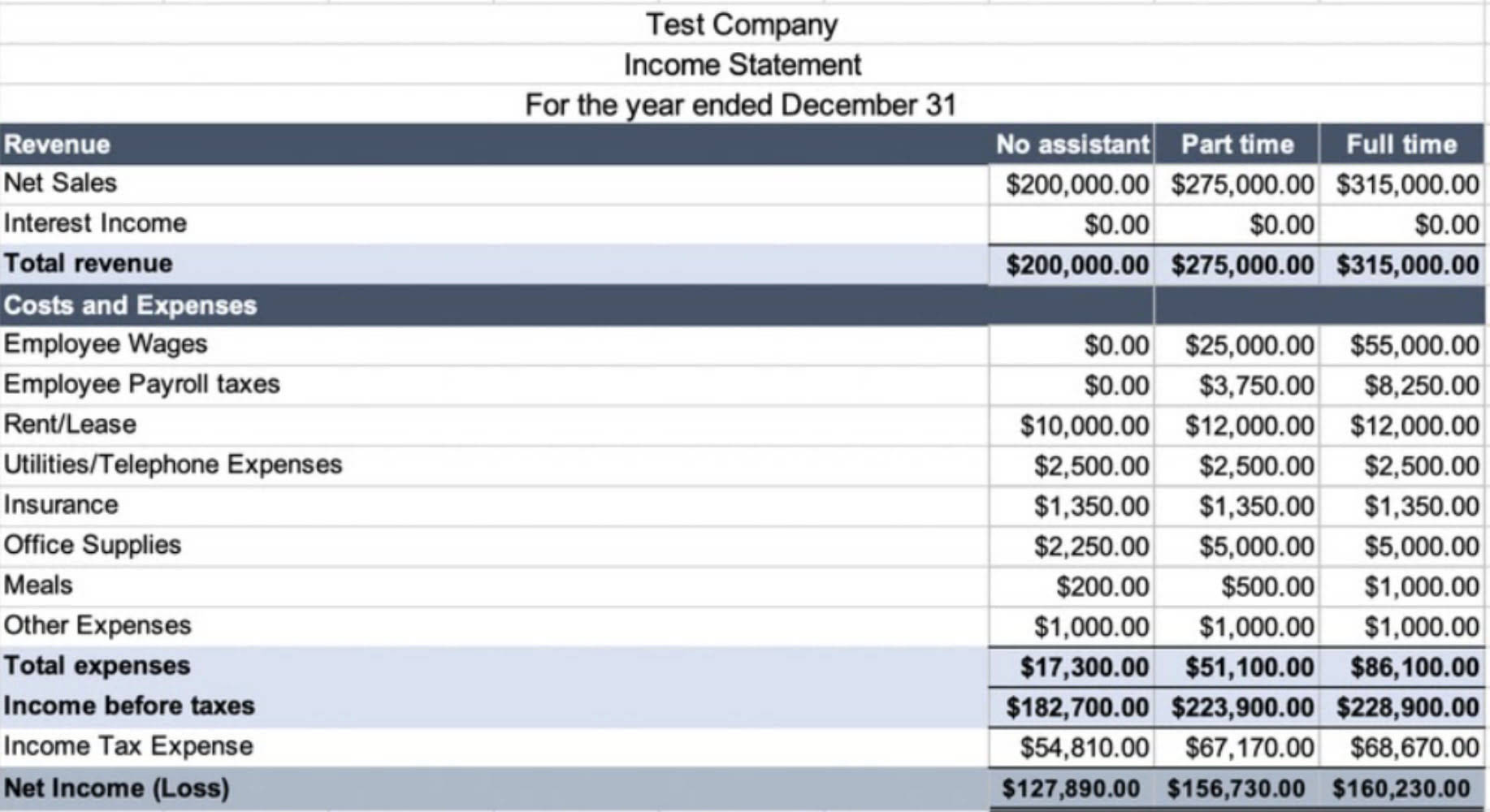

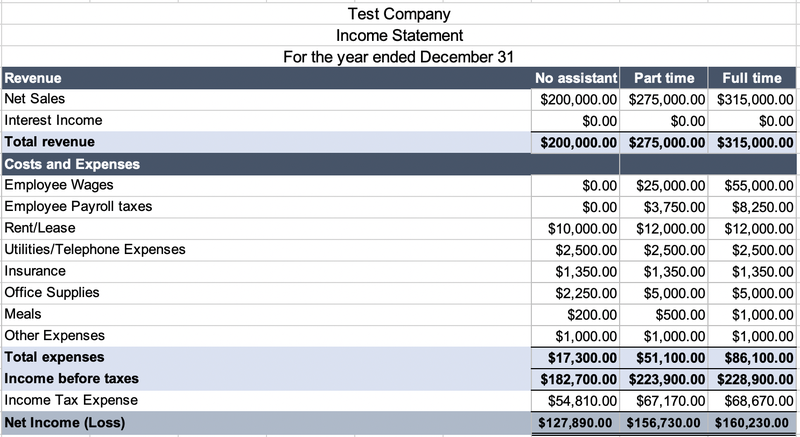

Pro forma statements are used for. Pro forma financial statements can be used to determine the timing of cash outlays and cash receipts within the month. A pro forma income statement is a financial statement that uses the pro forma calculation method mainly to draw potential investors focus to specific figures when a company issues an earnings. Proforma invoices are not always necessary but can be used as an integral part of your sales process.

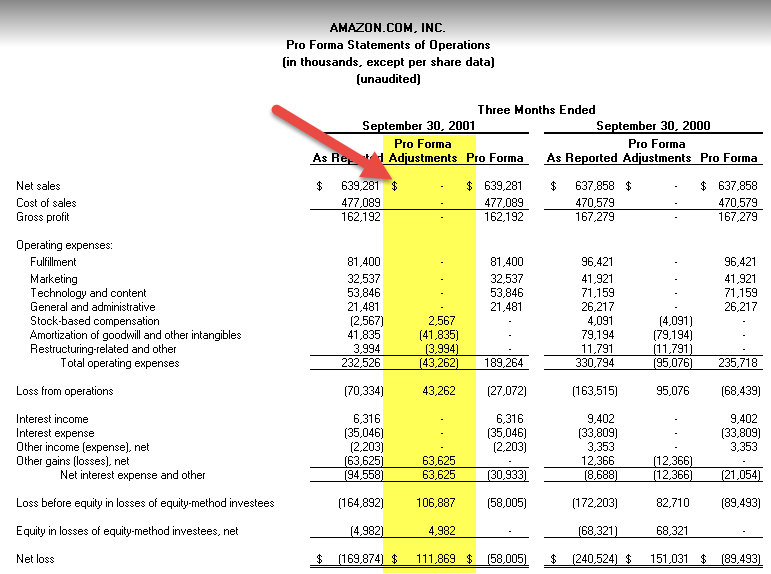

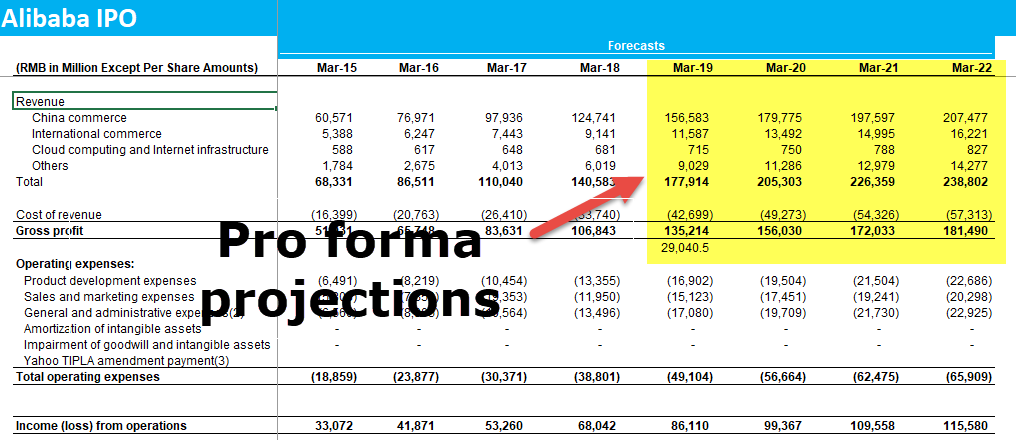

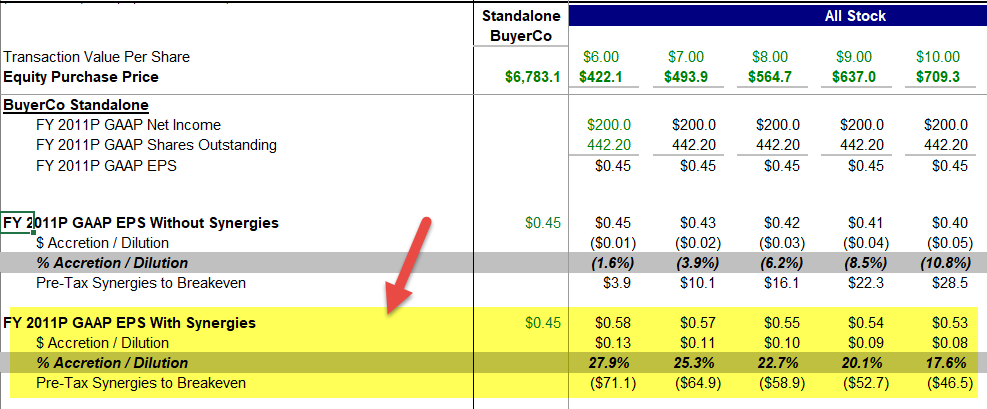

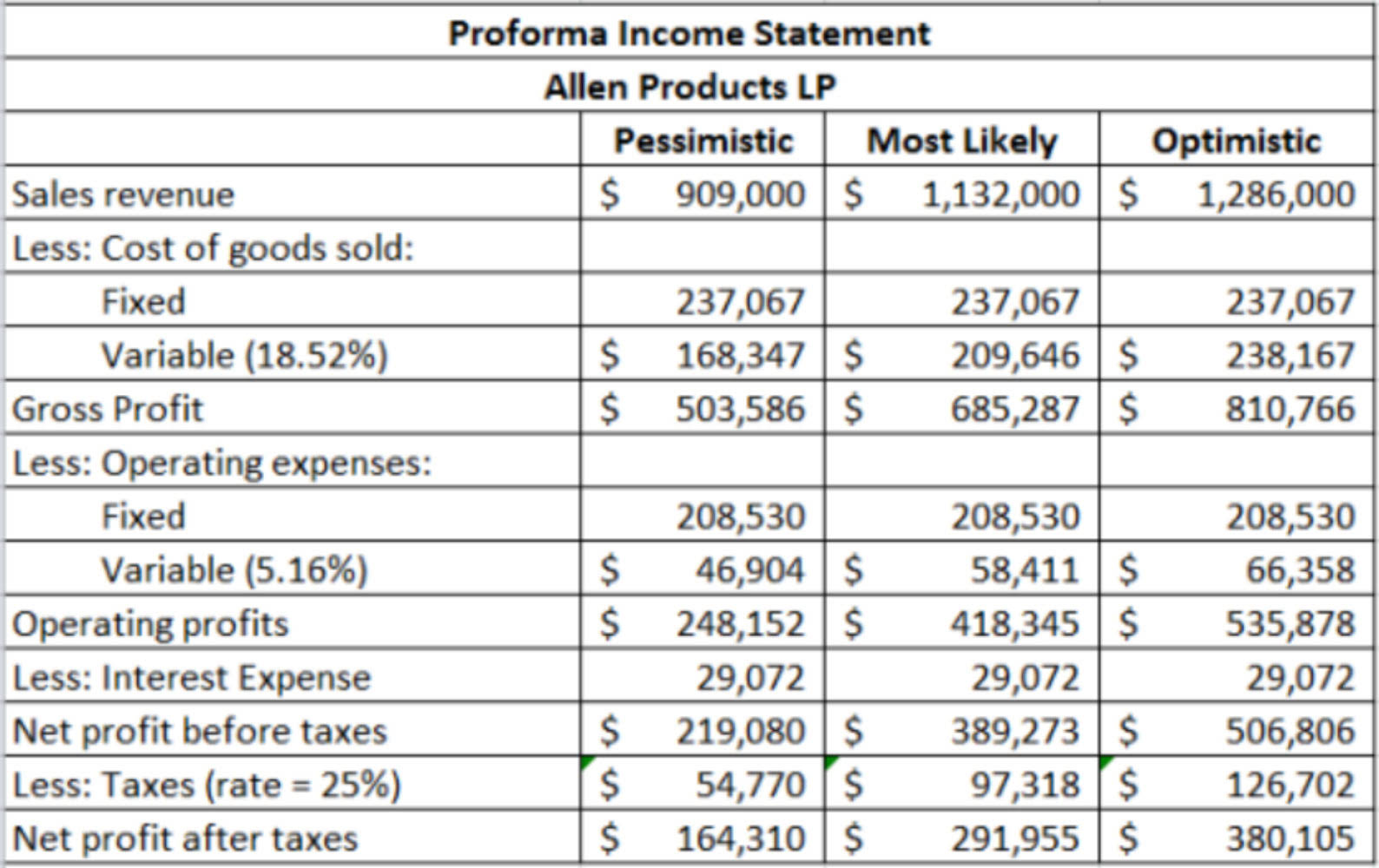

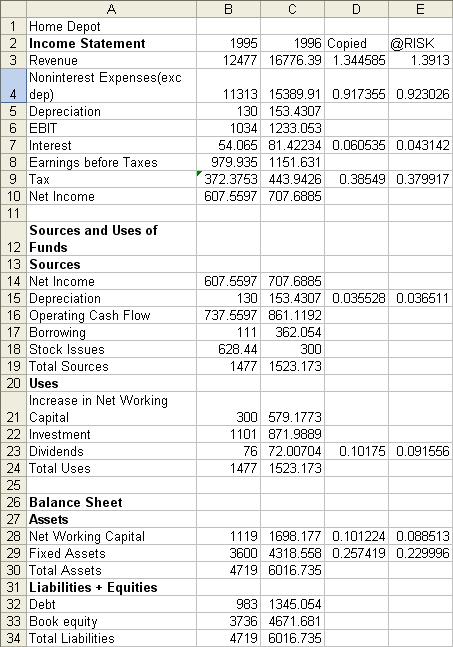

Acquiring another corporation or merging operations can be. One of the most common uses of pro forma statements is projecting the impact of a significant event perhaps a business combination or refinancing debt. Forecasts for Results of a Merger or Acquisition.

Pro forma statements show what the future will look likeIf expected results arrive. It is not a true invoice because it is not used to record accounts receivable for. If outside funds are needed pro forma.

When it comes to accounting pro forma statements are financial reports for your business based on hypothetical scenarios. A pro forma invoice. Pro forma financial statements are forecasted financial statements of a business based on certain presumptions or projections.

What is a Pro Forma Statement. It is used to declare the value of the trade. They can also determine whether sales can be expected to run above average in lets say June.

While similar to both quotations and invoices a proforma invoice serves its own unique purpose and can easily be created with the help of an invoice template. Theyre a way for you to test out situations you think may happen in the future. Just like the previous section a company can use a pro forma income statement balance sheet and cash flow statement to project how a significant event might affect its financial position.