Breathtaking Cash Flow For Industrial Operations

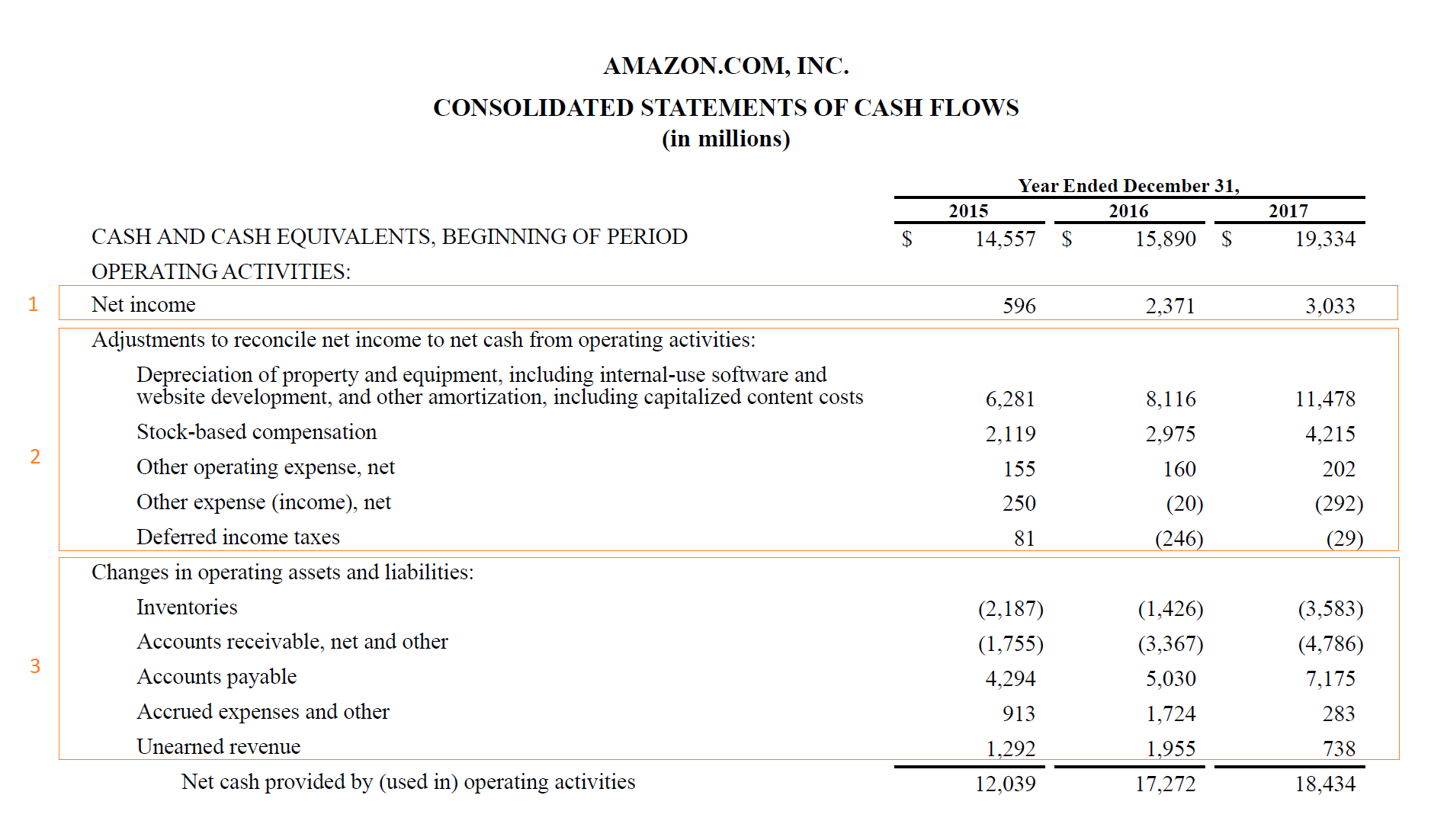

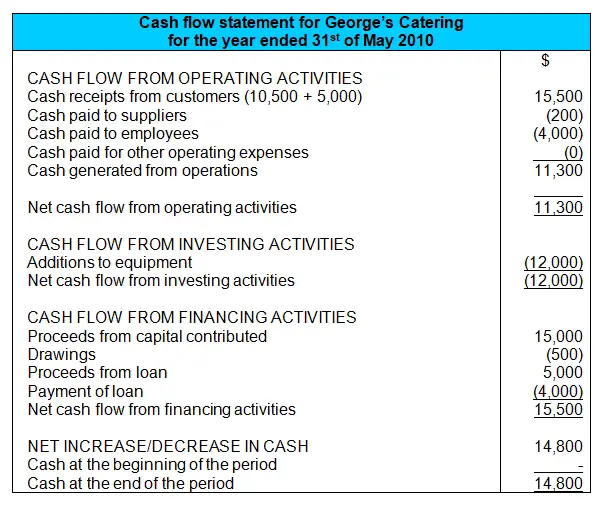

The purpose of a cash flow statement is to provide a detailed picture of what happened to a businesss cash during a specified period known as the accounting period.

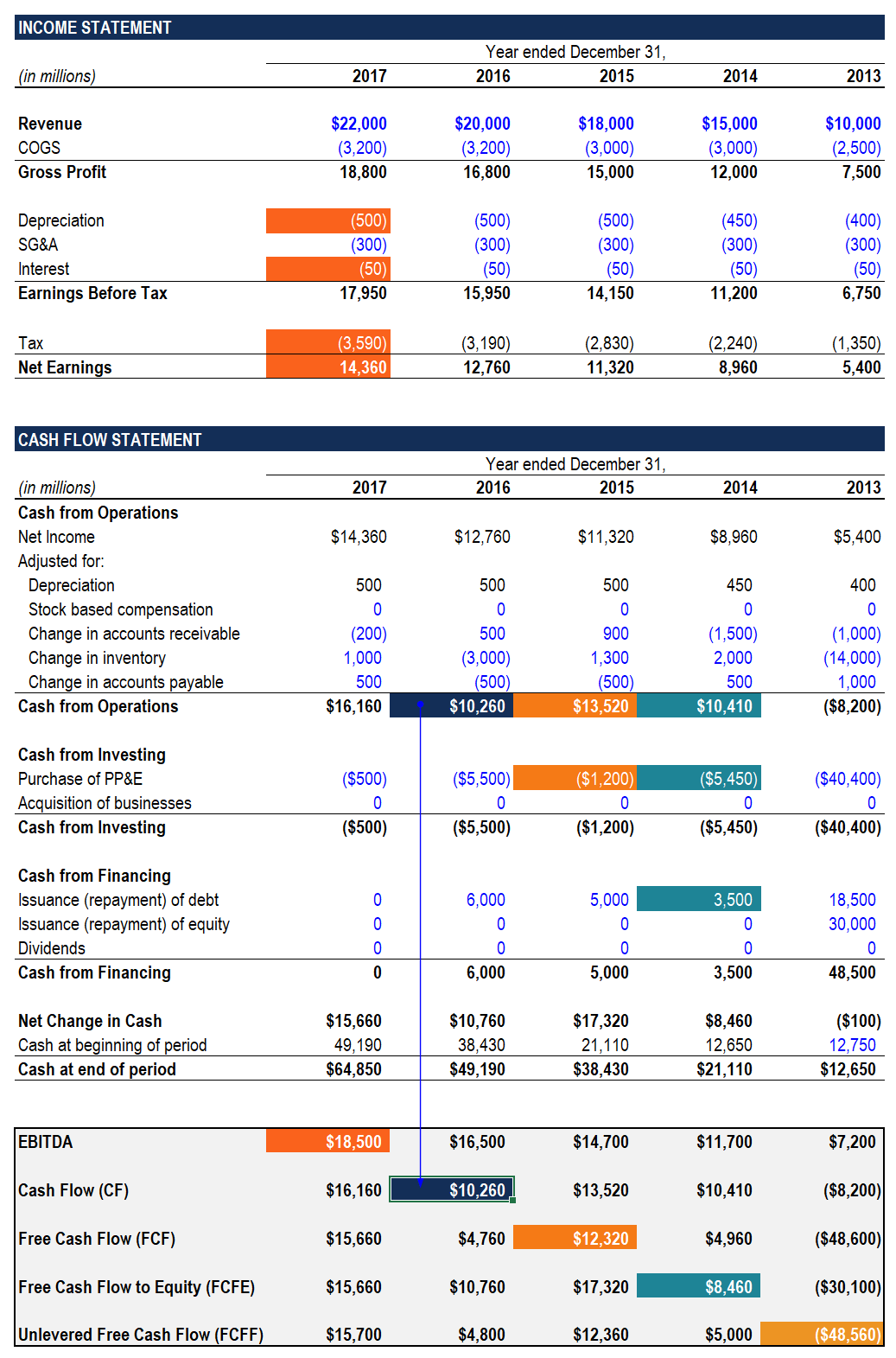

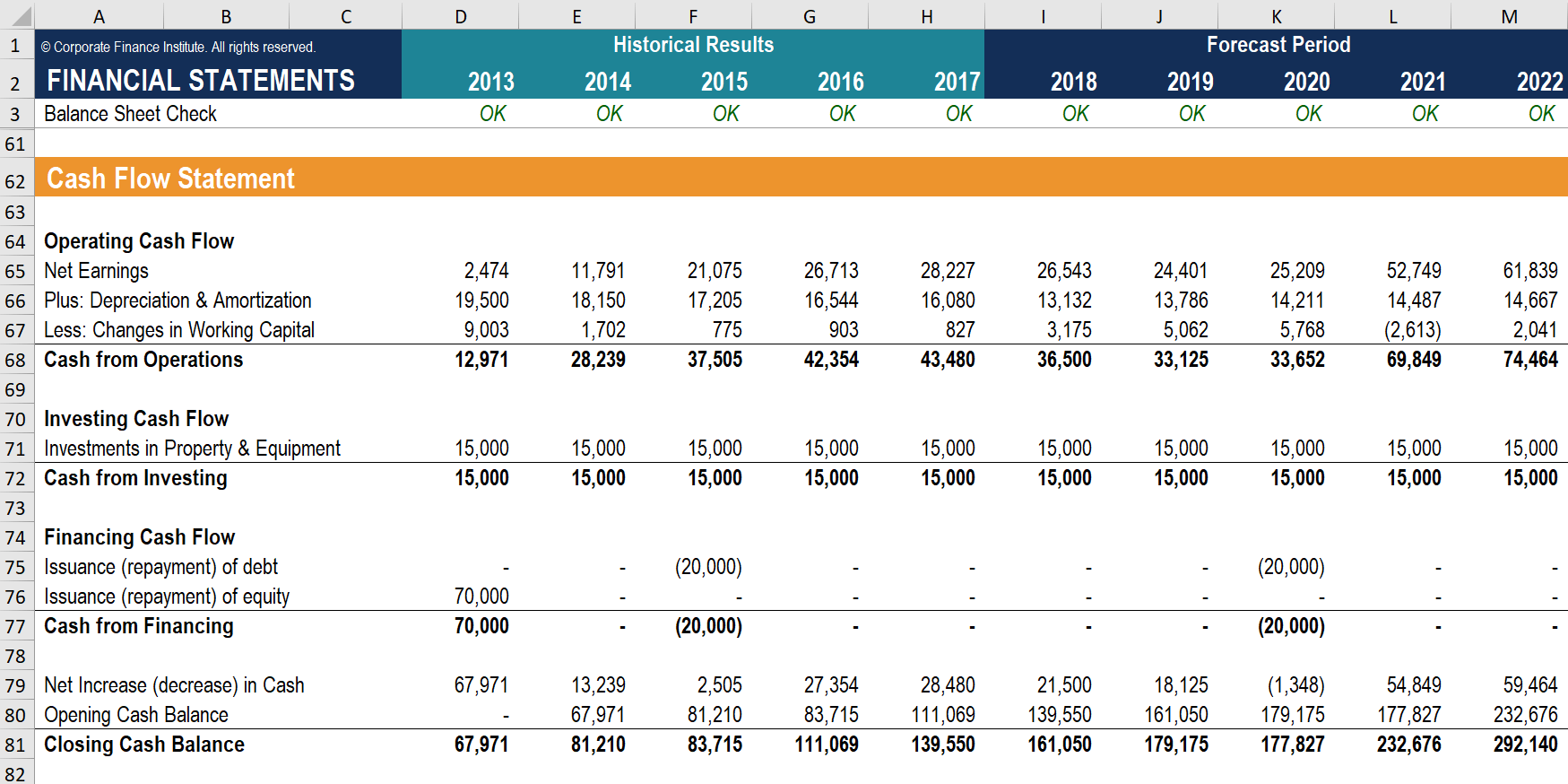

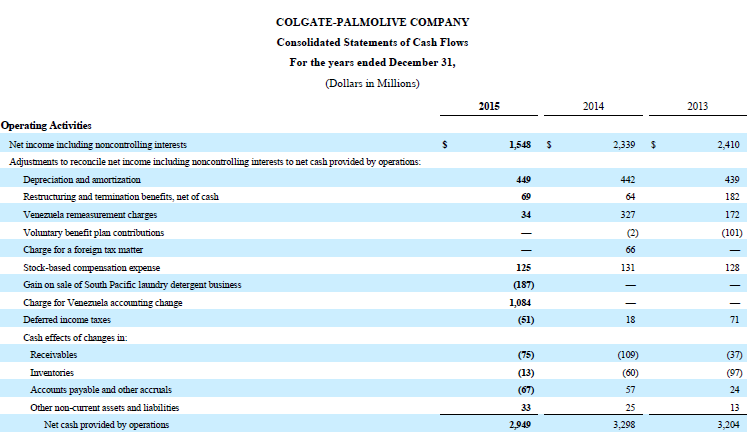

Cash flow for industrial operations. The operating cash flow OCF is the cash generated from the normal operations of a business. Cash flow from operating activities CFO indicates the amount of money a company brings in from its ongoing regular business activities such as manufacturing and selling goods or providing a. Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital Cash Flow Forecast Beginning Cash Projected Inflows Projected Outflows Ending Cash.

What is Free Cash Flow FCF and how do I calculate it. Cash is coming in from customers or clients who are buying your products or services. The companys chief financial officer CFO chooses between the direct and indirect presentation of operating cash flow.

Cash Flow from Operations Net Income Non-Cash Items Changes in Working Capital. Healthy businesses normally enjoy substantial cash inflows from their ongoing operations and sales receipts. What is the mearning of Free Cash Flow.

Operating cash flow before changes in working capital is a non-gaap measure. 1 day agoFree cash flow for industrial operations will be 35 billion to 5 billion this year the company projected Tuesday. 2021 Innovative Industrial Propertiess Net Income From Continuing Operations was 259 Mil.

Essentially operating cash flow shows if a company is generating enough positive cash flow to sustain and grow its operations. In simple terms the related cash inflow will be the adjusted operating profit. Cash flow is the money that is moving flowing in and out of your business in a month.

What is Free Cash Flow used for. For the three months ended in Mar. Boston-based GE previously forecast 25 billion to 4 billion.

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

/cash-flow-concept-992325826-02e39ab9d9394062817a6dd4c62b7a56.jpg)